Calculate your overall debt amount

When you can't keep up with your monthly bill payments, you may choose either debt consolidation or settlement depending upon your financial situation. To decide upon debt consolidation vs debt settlement, you should go for a free counseling with a debt relief company which will help you analyze which option will work better for you.

How to decide upon debt consolidation vs debt settlement

The most important factor that helps you decide upon debt consolidation vs debt settlement is whether you're capable of managing monthly bill payments at reduced rates. If this isn't possible, then you need to negotiate accordingly in order to settle your debt for less than what you owe.

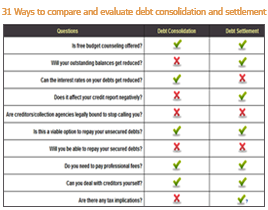

Finally, you can glance through our 31 Ways to compare and evaluate debt consolidation and settlement page to determine which debt relief option will suit you best. You can clear all your doubts regarding debt consolidation and settlement and take the right decision.

| # | Questions | Debt Consolidation | Debt Settlement |

| 1. | Is free budget counseling offered? | ||

| 2. | Will your outstanding balances get reduced? | ||

| 3. | Can the interest rates on your debts get reduced? | ||

| 4. | Does it affect your credit report negatively? | ||

| 5. | Are creditors/collection agencies legally bound to stop calling you? | ||

| 6. | Is this a viable option to repay your unsecured debts? | ||

| 7. | Will you be able to repay your secured debts? | ||

| 8. | Do you need to pay professional fees? | ||

| 9. | Can you deal with creditors yourself? | ||

| 10. | Are there any tax implications? | ? | |

| 11. | Can you become debt free within a month? | ? | |

| 12. | Can a creditor/collection agency sue you? | ||

| 13. | Do you need to have a valuable asset? | ||

| 14. | Is it true that you can repay bills with single monthly payments? | ||

| 15. | Do you need to make lumpsum payment(s)? | ||

| 16. | Do you have to take help from a lawyer? | ||

| 17. | Is it a suitable option to repay private student loans? | ||

| 18. | Is agreement signing mandatory? | ? | ? |

| 19. | Can it remove debts incurred from community properties? | ||

| 20. | Can you get rid of debt legally? | ||

| 21. | Does it help repay low debt amount? | ||

| 22. | Can you get help if you're delinquent on loans? | ? | ? |

| 23. | Can you become a victim of wage garnishment? | ||

| 24. | Is there any role of trust account? | ||

| 25. | Is it better than filing a bankruptcy? | ||

| 26. | Can you repay business debts? | ||

| 27. | Does it help repay payday loans? | ||

| 28. | Can you cancel the program midway? | ||

| 29. | Can you pay off one of multiple accounts? | ? | |

| 30. | Can it help stop foreclosure proceedings? | ||

| 31. | Does it help pay off medical bills? |

Should you pay in full or settle your debts?

When paid in full would matter over settlement

Paying a debt in full, however, might matter when you’re trying to repair your credit. During the process of home buying or auto loan shopping, paid in full accounts would be favored by the creditors over settled accounts.

You can also consider paying the debt in full if the creditor or the collector agrees to remove the information from the credit report if you do so.

Things to remember while settling an account

Whether you decide to settle or pay the debt in full, you must follow the steps mentioned below.

- Obtain settlement offer in writing: Make sure that you get the settlement proposal in writing from the creditor. Don’t get into a payment plan until you receive the terms and conditions mentioned in a paper.

- Negotiate for pay for delete: At times the creditor may agree to delete the negative entry from your report if you pay the account in full. The pay for delete would remove the item from your report altogether. It would help in repairing your credit score faster.

- Ensure creditor writes off the balance: You must get in writing that the creditor or collector ensuring that the balance on the account wouldn’t be sold to another collector in the future.