Is this a good debt settlement offer?

Date: Fri, 06/05/2009 - 21:42

Check out my very first post on this forum, I was in the same bo

Check out my very first post on this forum, I was in the same boat as you:

http://www.debtconsolidationcare.com/settlement/cdc.html

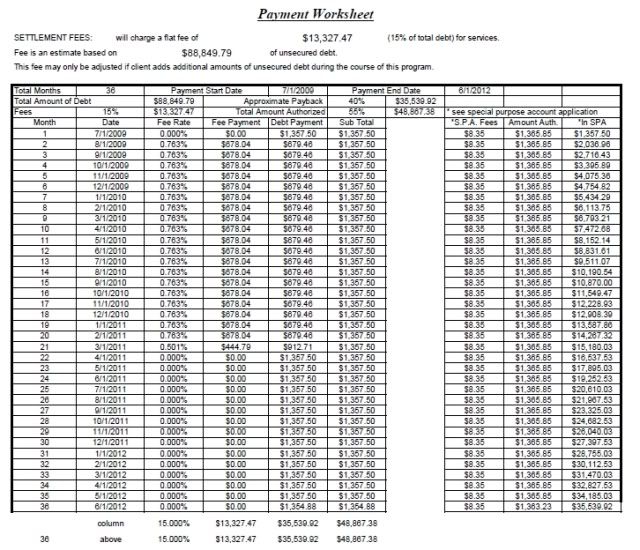

Do it yourself! Why pay $13,000 to a company that is going to do something that you can do yourself! Is it really worth $13K just so you won't get a few nasty phonecalls, a few threatening letters, etc? Use this forum as your source and you will be informed on everything you need to know.

Is it really worth $13K so someone else can write letters to creditors that you can copy and paste from this website and fill in the blanks?

Here is what I suggest, search this site for info on settling with your specific creditors, use the search function and type in "Chase settlement" or "Citi settlement", etc. Look at other's experiences with your specific creditors.

WHen they start calling, answer once a month and give them your SAME, CONSISTENT hardship story and don't agree to pay anything. Tell them your priorities (mortgage, food, utilities, and family expenses). State that you are looking at ALL your options right now, but don't mention bankruptcy, but hint at it.

At or about 90 days after your first missed payment date, send out a settlement offer using the examples and templates that are available here. Customize it with info on your hardship and mention the possibility of bankruptcy. Offer something ridiculous like 10-15%.

As you get closer to 120 days, when you do answer the phone or call the creditor, there is very little BSing around since they now know you are looking to settle and not enter a "program". Make sure you have the numbers in front of you and aim for 40%.

BTW, to put this in perspective... If you owe $88,850, then y

BTW, to put this in perspective...

If you owe $88,850, then you can realistically settle for 40% which is $35,540. If you save the proposed $1,360 a month, you will reach $35K in 26 months which is 10 months less than the company's plan.

If you can successfully settle for lower than the 40%, you will be out of debt quicker.

I just see paying someone $13K to do something that will take you a few hours a month to do on your own is ridiculous.

Just turn your ringer off and toughen up your skin.

Good luck