SOOO.....contestant number two, come on down!!!!

Date: Tue, 04/01/2008 - 18:51

This is a local CA to me. Small-time, mostly medical collections. They contacted me and claimed that I owed them $209. A little checking finds that they reported to my Experian file. So, I dispute with the CB. The very next day, this CA calls me:

"We see that you filed a dispute with Experian because this debt is listed on your credit report, how would you like to pay this off today?"

I told the lady on the phone that I wanted this debt validated. This is exactly, word for word, what she said to that:

"Well, we're just going to stamp this dispute "unpaid collection" and fax it right back to Experian, and thats all youre gonna get on this."

So, when I explained the fdcpa, and validation vs. verification, she again refused to send anything, saying, "I told you, thats all youre getting from me"

So, no validation. They verified the debt as unpaid collection on my report. That was February 13, 2008. I get my new Experian report, and wow, there they are still. She was right--they did verify it. They also didnt report it as "disputed by consumer", and while they claim the debt originated in 2005, the report states that the account was opened when they were assigned the account. Both of those are FCRA violations.

Of course, I contact Experian and dispute it again, informing them that this collector has been asked for debt validation in accordance with federal law, but has refused to provide it. That means they cannot legally continue reporting on my credit report. Experian sends them the dispute notice, and once again, I get a phone call. Wasnt home when it came though. They called twice yesterday, leaving voicemails about how I must contact them "before noon tomorrow" about this "very serious personal business matter"....Well, some of us work for a living, so I was unable to call them before they closed. Oh, thats another wierd thing--they are a collection agency, yet they close at 4 PM each day, except for Fridays, when they close at 1 PM. Wierd.

I checked my Experian file tonight. They already sent the dispute back, verified. So it is still on there.

So far, they have done the following:

1--continued collection calls while ignoring a DV request

2--incorrectly reported the "date account opened" information on the report

3--did not state in their report that "account disputed by consumer", an FCRA violation to leave that out.

4--continued collection activity by updating my credit report entry while ignoring DV request

5--specifically told me that they were not going to/didnt have to validate a debt

I think we have our next contestant!!

Looks to me like they just outsmarted themselves. :D

Looks to me like they just outsmarted themselves. :D

[quote=UnemployedRon]Outsmarted? More like Out-Dumb-Assed themse

[quote=UnemployedRon]Outsmarted? More like Out-Dumb-Assed themselves![/quote]

Looks like the irony of my remark went right past you, Ron...

Have you sent them a DV letter certified mail? New

Have you sent them a DV letter certified mail?

New

I didnt send them anything in the mail, I stated on the phone ca

I didnt send them anything in the mail, I stated on the phone call that I was demanding validation, and even though it was not sent in writing, that the recorded telephone call would suffice as proof that I informed them of this request. Her response was "I'll make a note of that, sir." and nothing else.

I have consulted with my attorney and I have been informed that even though the request was made verbally, it should still hold up in court, because I have recorded the call, and therefore I can prove that a debt collector from this CA received my request, and flat out told me that I am not going to get the debt validated.

I can't wait to hear the outcome of this one Jon. Good luck!

I can't wait to hear the outcome of this one Jon. Good luck!

But I think the law specifically states the request must be in w

But I think the law specifically states the request must be in writing. What can it hurt to send a CMRRR? That 5 bucks and some change can only help your case further, since you not only have a verbally requested validation, but an official written one, it will be quite clear they have no intention of honoring the law or your rights..it could only help you. :)

the law also allows for no deception whatsoever, and when you as

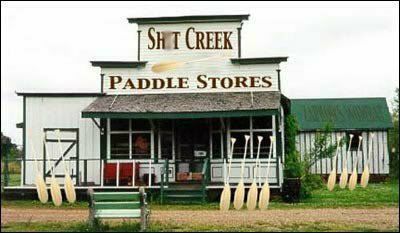

the law also allows for no deception whatsoever, and when you ask them, be it by phone or in writing, for validation, it is 100% illegal for them to tell you they cannot, tell you they wont, tell you it isnt allowed, tell you "thats all youre gonna get", or anything else other than "yes, we will do that for you". The law does not allow them IN ANY WAY to deny a consumer their right to validation. So, no matter how I notify them, I have this lady using deceptive practices in an attempt to collect on a debt. That combined with the fact that I can prove that I asked for this validation and they refuse to provide it puts them in one smelly creek with no paddle.

...especially considering the fact that they "validated" it to E

...especially considering the fact that they "validated" it to Experian.

verified it not once but twice.... as for the written notice, t

verified it not once but twice....

as for the written notice, the law is designed to be measured by the "least sophisticated consumer" standard. That means, when a CA tells someone something, they look at that law, and look at what the CA has done, and then think, "what would the least sophisticated person think as a result of the CA's action/statement?"

A good example of this is in the letter that these idiots sent to me, came in the mail just today. The letter says:

??

??

Note the "permanent credit record" part? Nothing is permanent about your credit report.

[quote=skydivr7673]The law does not allow them IN ANY WAY to den

[quote=skydivr7673]The law does not allow them IN ANY WAY to deny a consumer their right to validation. So, no matter how I notify them, I have this lady using deceptive practices in an attempt to collect on a debt. That combined with the fact that I can prove that I asked for this validation and they refuse to provide it puts them in one smelly creek with no paddle.[/quote]

I think you've got'em by the short hairs, bud. I look forward to hearing how this turns out.

BTW, I'm starting a new business, and looking for investors. Interested?

I didn't mean that the phone call could not be used, I am sure i

I didn't mean that the phone call could not be used, I am sure it can! I was just pointing out that a letter could not hurt and would just cement your case all the more, shows the judge that you made every attempt to get the validation.

I would have to go back and look at the FCRA and stuff again, since I pretty much use Texas law, and in texas law it states that it must be in writing, however as I said, I was just poitning out "what could it hurt?" :)

the fdcpa says in writing as well. but they just sent me a lett

the fdcpa says in writing as well. but they just sent me a letter telling me that I had 5 days to respond before they take further action---so I may not have the time to wait on a DV letter....

no, because they have been reporting on my credit report since t

no, because they have been reporting on my credit report since the end of last year, so the 30 days is up. Funny thing though--I check my reports around the beginning of the year to see what has been added. Thats how I knew about them. They never sent me anything in the mail concerning the consumer rights disclosure. But the 30 days since initial communication has passed, so no overshadowing has taken place. Unfortunately, I didnt know about them until February 2008 when I checked my report. But even then, 30 days expired from that point until now, so they are in the clear there.

At this point they have at least five separate violations, and several repeat violations, of FDCPA/FCRA. The repeat violations only serve to strengthen a case like this--my understanding is that you can sue them for "continuing to call while ignoring a DV letter" and seek $1000 for that offense....but you cannot say "they called 37 times after I sent the DV request, and they didnt validate, so I am seeking $37,000.00." Otherwise, the total would have increased again today--because they called my house this morning. Funny thing too--I recorded a voicemail that I left for them the other day(I get home from work after they are closed), and in that recording I also told them that they are not allowed to call me by telephone at any number where I may be reached, that all communication is to take place in writing through the mail. I recorded this message as proof that I left it. Then they start calling again anyways. So, I guess in that respect, the total DID go up today....now up to $6,000 I am seeking on a $209 collection. I hope that its worth it to them....

Although reporting on your credit report is considered collectio

Although reporting on your credit report is considered collection activity they never sent you a dunning letter though right? I'm sure in a court of law it could be articulated as overshadowing.

:D

It's all how you word things my friend.

yeah, but I had telephone contact with them in the beginning of

yeah, but I had telephone contact with them in the beginning of February when I found this out on my report. So, it has now been more than 30 days. If anything, it isnt overshadowing, because more than the 30 days has passed since first communication. But it IS failure to disclose consumer's rights, which is yet another violation of the fdcpa....

man, that dollar amount is climbing faster than a Jerry Lewis Telethon.... :lol: