Update & I hate BofA

Date: Tue, 01/22/2013 - 16:12

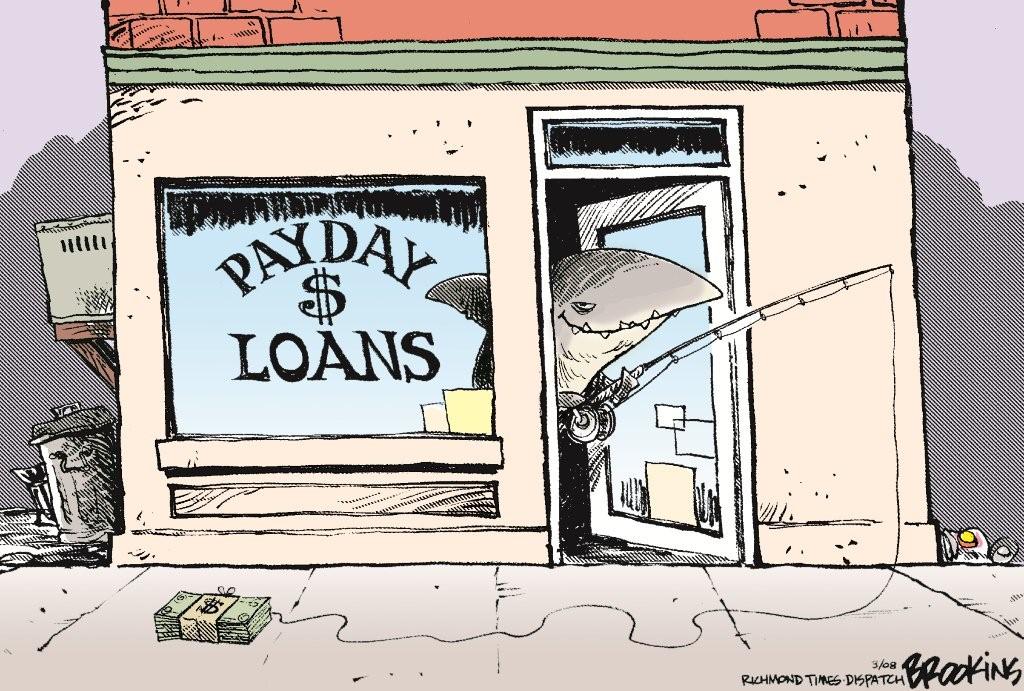

Today I wake up to 3 emails from the PDL saying, thank you for renewing my loan. My next payment is, blah, blah blah.

I also woke up to 1 email from Everest saying that they are considering my account PIF and thank you for my business.

One of the 3 emails from the PDL saying thank you for renewing was from Everest, I contact Wendy at Everest and she explained that the withdrawal went through at midnight and that she sent the PIF in the morning. She said if the account is closed it will drop off tonight at midnight and they will not attempt to charge it again.

I called BofA and normally it would say that my account balance is $0, today is said I was overdrawn $380. I was furious, called BofA and was told that eventhough I closed my account it remains in a limbo state for 30 days, I yelled at the agent and explained that I was told 5 different times that its supposed to be 3 days, not thirty. She apologized and said I was given the wrong information. She did say that because the account is closed that these payments would drop off tonight, and to please call the lenders and tell them not to try again. (Huh, if it where that easy) Now the account is back on limbo for another 30 days, which means I will be dealing with BofA for a while until this all stops. They did say that if it doesn't drop off, I should contact their fraud department. If the account is closed and they just told me last week that they account was on a "do not let anything through" status, why the heck would they let anything through!

The 3 that put things through are Everest, Advance Me Today and 7 Day Loans. I reported all of them to the AG and FTC today, again.

The other 2 loans are United Cash Loans which has a weird thing on their page showing a balance but showing that nothing else is do and that there is no payment scheduled.

Plain Green loan lets me sign in but tells me that they have incorrect account info and that I need to call in and give them the correct info.

I will update tomorrow to see if BofA does drop the charges and doesn't allow anything through.

Has anyone had any of these issues before? What can I expect?

Well for starters, faxing to

Well for starters, faxing to the branch that opened the account is total BS. ANY branch manager could have done this for you.

You are confusing the 3 days and the 30 days. Your BOFA account might be in limbo but REG E requires 3 days notice of an ACH revocation. If they do not drop off, you have the ACH revocations to fall back on....it is then THEIR problem not yours. They must comply with the law.

Customer Service Agents over the phone dont know SQUAT about what you were talking about. You should be dealing with a local branch manager only....not a teller and not a personal banker. If a branch manager will not help you, demand that they get the district manager on the phone asap.

It all worked out

I was not confusing 3 with 30. I was told a few times by the customer service rep on the phone that the account was going to be in limbo for 3 day to fully close. She knew nothing about my revocation letters yet, I waited the 3 days before I send them or gave them to anyone. I had to do it by fax and confirmed with the branch manager that they were received. This morning my account is back to $0, which means they did drop off and BofA did not pay them. I am sure they PDL will try again and if they do I will call the fraud department of BofA and make sure they are not able to even try again. I know they will change their names and try again but hopefully by then the account will be completely closed.

Letter from Plain Green

Just another update, Plain Green emailed me today and agreed to pay the remaining balance on the principal. They said I can pay it in one lump in a couple weeks. I replied that it doesn't work with my payday and can pay in 2 payments. Let's see what they say. That is 3 down and 2 to go to hear from.

Thats weird i had to close my

Thats weird i had to close my bank of america account because of this and they assured me no charges will be let through and that it only takes 1 to 2 days to fully close. I actually read your thread yesterday and called again just to be sure and they assured me no charges can come through on a closed account. I would stress about it anyways if any do come through i would dispute it and get it dropped immediately.

That is what they told me.

That is exactly what they told me, 5 times on the phone and 1 in person. Then they let 3 charges go through. They did reverse them at the end of the night. The problem is that since the account was touched we are now back to the 30 days. I would call again and ask about this 30 day thing. Just in case and keep an eye on it.

BofA is Alright with me

Hi David. BofA did the same thing to me. Scared the hell out of me by letting all the debits go thru & then reversed them all after a couple of business days. I did stop payments, so I'm closing my account because I am sure they will all try again with different payment amounts. Luckily my branch is within walking distance. Hopefully this hell will be over for all of us soon. Good luck.