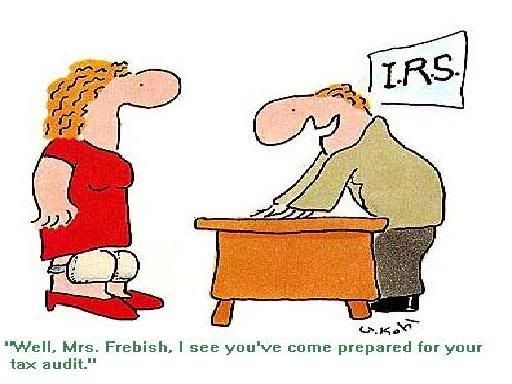

What are you going to do with your TAX REBATE?

Date: Tue, 03/18/2008 - 09:17

Submitted by SUEBEEHONEY70

on

Tue, 03/18/2008 - 09:17

Total Replies: 25

The IRS has recently updated their website with an actual calculator you can use to find out exactly how much you will be receiving, rather than guessing about it. All you need is your 2007 tax return - enter a few details, and you've got your answer. The only thing to remember is that if you have outstanding tax issues or money owed to the government, your rebate may be reduced by that amount.

There's also a new chart on the IRS website showing exactly when to expect your rebate. And an important thing to remember is that if you opted to have your tax refund direct deposited into your bank account when you filed your 2007 tax return, your rebate will come to you the same way. If you opted for a check to be mailed for your refund, you will also receive a check for your rebate.

If you are of the percentage that hasn't filed a tax return for some years (due to lack of taxable income), you will need to file a tax return to receive the rebate.

Soo..with all that said, what are your plans for the upcoming rebate payments?

As for me, I have the usual trip coming up in the summer to get my younger son to his dad for visitation in another state - so we're going to make a mini-vacation of it and hit a theme park, some nice beaches and maybe a few museums or points of interest along the way. :D

Mine will be gobbled up by the IRS for the back taxes I owe from

Mine will be gobbled up by the IRS for the back taxes I owe from when I was collecting unemployment several years ago. If they screw up and send it to me anyway I will probably use it to fly home with my wife so she can see her family after giving a portion to charity!

Well.. come to find out a few weeks ago I owe the IRS some money

Well.. come to find out a few weeks ago I owe the IRS some money.. so I don't think I will be seeing anything and if I do I'm going to send it right back to them.

All very good ideas - and after discussing things with my older

All very good ideas - and after discussing things with my older son today, I'm thinking part of my stimulus payment will be going to get him started on driver's training - remember the good ol' days when that was part of your education and was FREE? Not anymore... :evil:

I owe the IRS, but I am on a formal repayment plan. From what I

I owe the IRS, but I am on a formal repayment plan. From what I read, I will get my check as long as the taxes arent delinquent. Alas, I will probably turn around and send it back to them

I paid $400 for my daughters drivers training here in CA. I do remember when it was free...that was nice!

Well, gas is $3.25 per gallon, but the bike gets about 52 mpg...

Well, gas is $3.25 per gallon, but the bike gets about 52 mpg.......

let it never be said that our dear wulf is not, among other thin

let it never be said that our dear wulf is not, among other things, SMART. ;-)

Hey, I figure the pittance they'll be sending us [unless they ch

Hey, I figure the pittance they'll be sending us [unless they change their minds] is good for about 4k miles. That's a week's vacation in the wind, on the cheap. :)

I agree...if you owe something..at least it was free money that

I agree...if you owe something..at least it was free money that you sent them to pay off debt...instead of stimulating economy..but people who owe IRS money didn't even get tax refunds in first place if I am not mistaken

Yeah, pretty much. OTOH, the refund amount gets taken off of wha

Yeah, pretty much. OTOH, the refund amount gets taken off of what they owe the Infernal Revenue Sadists, so it's not a total wash.

I'm torn on what I'm doing with my check. The responsible thing

I'm torn on what I'm doing with my check. The responsible thing for me to do is pay $600 off of my debts. That $600 is my monthly payment to my debt consolidation company and could mean one month early of getting out of debt. But the voices in my head are saying buy a PS3 or Wii. I don't know for sure what I'm doing yet.

I am so buying myself a new mattress, no more down hill slope to

I am so buying myself a new mattress, no more down hill slope to the middle for me..... I am so pumped..

Quote:I'm torn on what I'm doing with my check. The responsible

Quote:

I'm torn on what I'm doing with my check. The responsible thing for me to do is pay $600 off of my debts. That $600 is my monthly payment to my debt consolidation company and could mean one month early of getting out of debt. But the voices in my head are saying buy a PS3 or Wii. I don't know for sure what I'm doing yet. |

Don't know how much longer to go until you complete consolidation, but if you wait, there is always the chance that the prices will drop if you wait.

Generally as a rule I do not use my income tax to pay off debt.

Generally as a rule I do not use my income tax to pay off debt. I did this year however because the was a quick end in sight. I try and budget my money pretty well through the year so I feel anything I get back is bonus time.

This year I made an error on my taxes so I am sending the check back to them before they hunt me down.

I agree fyi most people generally don't these days use income ta

I agree fyi most people generally don't these days use income tax refunds to pay debt..they normally go out and buy more things to have something hopefully in their possession to show to themselves a REWARD for previous year of work and labor....they don't want to pay debt..they want to have something to reward themselves for the hard work they put in and paid all their taxes on the previous year...Fyi what kind of error did you make?..I hope you didn't falsely misrepresent anything....honest mistakes happen all the time and I am sure this is what you must have done...I have a friend who recently tried to purchase business site he has been leasing for 9 years with the equity in his home as collateral---- amazingly he still had built up some considerable equity in times like these!... the IRS took his $90,000 equity he thought he could use to purchase building as down payment.. they swooped in and took it....(from debts on family farming business that was defaulted on in the early 90's when government bailed on the subsidies they were paying farmers to bury crops and banks stopped lending) ---they will hunt you down forever! best of luck in whatever mistake you made!

If we do actually get something(I don't believe it till i see it

If we do actually get something(I don't believe it till i see it) ours will go to make repairs that our insurance didn't cover from our big ice storm. Also, will have to go for some dental work,that and our income taxes :x karen

BTW--Fyi, one time a tax preparer made an error on ours, I didn't catch it until later, then called them and sent them a check.

We have also owed taxes in the past--they were some of the easiest ones to work with, I told them what I could afford and payed on it for some time..karen

I so agree Karen..they seem like the easiest because they do hav

I so agree Karen..they seem like the easiest because they do have laws to follow and get in trouble if they step over the line....when you told them what you could afford..did you have to pay penalties?..From my experience of friends and acquaintances...the penalties for not paying when you owed amount is what adds up and accrues big time....also something I never realized is that if tax preparers make error you are responsible for errors they made..I am so glad you caught the error and were able to call them BEFORE they called you! I am amazed that the interest and penalties did not overwhelm your debt to them and that you were able to get this paid off Karen good for you!

Yeah, there were penalities, but I don't remember them being rea

Yeah, there were penalities, but I don't remember them being really big.

Even though you set up a payment plan and pay on time monthly, you still get the penalty charge until it's paid off.Our debt wasn't huge to them either, so that probably makes a difference in what penalities you pay..karen

If we get anything, it will go toward either bills or toward nex

If we get anything, it will go toward either bills or toward next years marching band fees, who knows. I guess it will all depend on what we get. I am not counting how much money we will spend until I see the check.

Once I get mine I am sure I will be using it to pay on credit ca

Once I get mine I am sure I will be using it to pay on credit cards. Hopefully I can get my Circuit City one back under control.

If they ever decide when they gonna give me the durn thing,we wi

If they ever decide when they gonna give me the durn thing,we will pay off some medical bills & use rest around the house.

Well, they finally got my info posted [last numbers: 28, direct

Well, they finally got my info posted [last numbers: 28, direct deposit]. IRS.gov says I should have it in the bank by 5/9. Looks like the original schedule to me...

Still, it'll be nice to finally get it. Get ahaed on some bills, and take a nice, long bike trip with the remainder.

I got in the mail the offical notice of how much my stimulus pay

I got in the mail the offical notice of how much my stimulus payment is $300.00 and that it should be in my account 5/2/08 well the stupid letter is dated 5/5/08.

I didn't know that they worked on Sunday's and I could receive it 24 hours later :roll: . What morons. Anyway because of my idiotic mistake of accidently filing two 1040a's because I didn't think the first one, and also because I am on disability I don't have to file a tax return, told me that mine is under review and that if I don't receive it within 60 days to call them :twisted:

I am just so mad at myself I could scream.

I am putting half in savings and the other half is going to some

I am putting half in savings and the other half is going to some much-needed clothes for work, my mom and grandma's mother's day gift and anything left over I will probably just sock away for a rainy day.

waterbug...your mother's day and grandma's day gift..is one of t

waterbug...your mother's day and grandma's day gift..is one of the best things I have seen from the stimulus spending..that in these tough economic times your Momma and grandma are gonna be rewarded! :D :D ..they will love you no matter what they receive but fact you are spending your gift to gift them reminds me of the old classic tale "Gift of the Maji"..you will be rewarded in return..eventually ....good for you kind heart! :D