Watch video: How credit counseling helps you pay debt and save money

Video on Credit counseling pros and cons by Michael Bovee

Why should you get credit counseling help?

- Manage your bills responsibly

- Reduce your monthly payments

- Manage your debts smartly

- Develop a realistic budget

- Get an affordable repayment plan

- Know how you can avoid or stop foreclosure

- Widen your financial literacy

- Decide whether or not you need to file bankruptcy

- Repair your credit slowly but steadily to prove your creditworthiness

Credit counseling - The first step to solve your debt problems

How much

debt consolidation

can save you

When should you go for credit counseling?

- You’re facing difficulty to make the minimum payments on your debts

- You’re having problem to figure out your total debt amount

- It’s becoming difficult to manage your multiple cards and payments

- You’re using only credit cards for daily expenses

- You’re using one credit card to pay another

- Creditors are calling you for payments

- The balance on your account is close to your credit limit

- Creditors are not increasing your credit limit

- You’ve taken out or thinking to obtain a payday loan for some cash

- You've been living paycheck to paycheck, and can't find any room in your budget

- You’re thinking whether or not a DMP or a debt consolidation program might help you resolve your debt problems

Where can you go for credit counseling help?

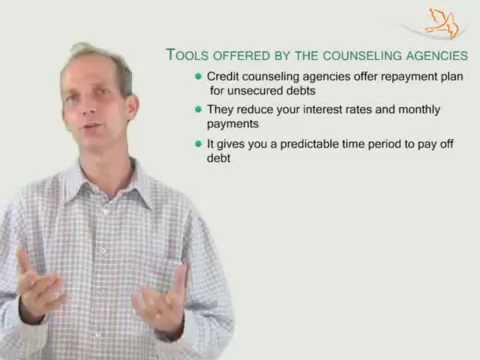

How can credit counseling help you repay debts?

When you’re having problem to manage your multiple bills, you can approach an American consumer credit counseling company.

The company will:- Make a comparative analysis of your income and expenses

- The counselor will share tips to budget and manage money smartly

- If you can’t solve your debt problems even after following the tips and suggestions, the counselor will offer you a debt management plan or a DMP

How do I find a good credit counselor?

Just like you buy other things only after comparing it with all possible options, shop around for a counselor. You should avoid companies who charge hefty fees with a promise of solving your problem quickly. There is no such possible magic trick.

Get the facts clear. Everything should be disclosed upfront. The service should provide budgeting advice and education.

You shouldn't fall for the namesake non profit. Non profit doesn't mean cheap or affordable, or good. You need to delve beneath the surface.

The counselor must spend an appropriate time with you in understanding your financial hardship. He should be very patient.

Credit counseling - Types and forms

Types:

| For profit counseling organizations | Non profit counseling organizations | |

|---|---|---|

| Fees for counseling | Usually charge a fee for the counseling services | Usually offer counseling services free of cost |

| Fees for DMP | Need to pay professional fee if you enroll in a DMP | The professional fees for DMP is relatively less |

Forms:

| Traditional credit counseling | Online credit counseling | |

|---|---|---|

| Mode of communication | You can interact with a counselor face-to-face to discuss your financial situation | You can fill out a form and get counseling sessions 24*7 at the comfort of your home |

6 Questions you should ask to choose the best credit counselor

-

1Is the credit counseling agency licensed to operate in your state?

-

2Will you get any written agreement if you enroll in a DMP?

-

3Are the counselors certified from NFCC (National Foundation for Credit Counseling)?

-

4How much do you have to pay for the counseling services?

-

5Will the counseling agency give you any educational materials?

-

6If you’re going for bankruptcy counseling, then ask, is it a government approved organization?

FAQ

When do I need credit counseling?

You need credit counseling if you're in any of the situations given below:

- Your credit balances exceed your income

- It's hard to make the minimum monthly payment on your debts

- You don't even know how much you owe in all

- You're using credit cards for daily expenses

- You're getting creditor calls for not making bill payments

- You're using one credit card to pay off another

- Creditors are not increasing your credit limit

- You're applying for cash advance to get some cash

Are the counselors qualified?

The counselors that deal with your financial issues are well read about the theories, principles, issues, counseling techniques, and the forms that are applicable to credit and financial counseling.

Can the counselors offer legal opinion on my options?

The counselors only guides you about handling your finances. They can't offer any legal solution. Only an attorney can provide opinions about legal issues.

Will credit counseling affect my credit score?

Credit counseling will not affect your credit score directly. However, the fact that you are taking up DMP to pay your debts would be mentioned in your credit report. A debt management plan usually takes 3-4 years. It would be stated in your credit report that you're paying an account through a credit card agency and it remains until the account is paid in full. However, This might affect you in obtaining any new credit. Although, it's not obvious and can't be predicted.

What should I carry to my credit counseling session?

You would like to discuss about your finances in detail with your counselor. You must carry few things in a session with your counselor:

- Your credit card statements

- Your current pay stub or proof of income

- The list of questions for your counselor

- Any kind of correspondence you had with your collection agency or the I.R.S.

- A list of your sources of your monthly expenses and income sources