Is debt consolidation program is right for you?

- Have multiple bills such as spiraling credit cards, medical bills, payday loans etc.

- Owe a lot of money to several creditors or collection agency.

- Are on their jobs and have moderate income.

- Wish to avoid filing a bankruptcy.

- Can't keep a track of several bills payable to creditors.

- Can carry on with monthly payments, though at low rates of interest.

- Can cut down on their spending and save money to pay off bills.

- Stop charging on their credit cards and avoid incurring additional debt.

Hi! Welcome to DebtConsolidationCare - The Internet's first get out of debt community.

Every year many millions of people come to our website and get help and information that they're looking for on topics mostly related to debt and credit.

We've just redesigned our website and made it easier for you to get to the information that you're looking for. Up above you'll see that we cover the most popular topics would you like to learn. How to get out of debts in 4 or 5 years with a reduced monthly payment by using credit counseling tactics and debt management plans.

Do you want to connect with a professional? Do you want to do it on your own? Do you want to calculate your options? Do you want to compare those options all that's available to you when you click on that tab? Would you like to learn how to avoid bankruptcy by using negotiation and settlement strategies with your creditors? Would you like to connect with a professional who can show you and assist you in doing just that? Would you like to learn how many of our hundreds of thousands of community members have been able to do that for themselves through our forums. That informations are there.

Are you dealing with a debt collector? Well, 1 in 7 Americans are right now. So if you're here looking for information about a specific collector that you received a phone call from or a letter from, click on debt collectors. Learn about how to deal with those situations.

Do you need a professional to help? Have you been a victim of harassment from a debt collector? We've got resources and professionals for you to connect with. In fact, at any time if you need professional resources on any of those topics, pick up the phone, call the 800 number that you see on your screen throughout all of our website and get connected with one of those professionals and talk with them at no cost to you.

Do you need credit recovery? In other words, you've had a negative credit event and you're trying to recover your credit profile or your score, fix items that are inaccurate. When the credit reporting bureaus report in front of Congress that over half of the files that they maintain on Americans contain inaccurate erroneous information, you might just want to take a look at our credit monitoring section of our website. We've got a ton of tools that are available for you. Letters, things that you can start to do to be proactive in helping yourself help your credit because nobody else is going to do that for you.

Bankruptcy. Very popular in today's economy. Over a million people file for bankruptcy each and every year. Would you like to learn more about bankruptcy? Why most people think it's an option of last resort when it can actually be considered as an option of first resort?

How do all of your options stack up against bankruptcy? Sometimes bankruptcy makes a lot of sense. Click any one of the topics that are most popular and a little sub menu will open up and you'll see the forum section. Click a forum, go right there, and you'll find where information is being shared every minute here on our website. So you can learn what other people are doing, how they're navigating and even some of our moderators and experts learn from them as well.

We've put together so many tools here at DebtCC for you to embrace, use, get results. We've got calculators. We know for every question there's an answer, for every problem there's a solution and we've got access to both.

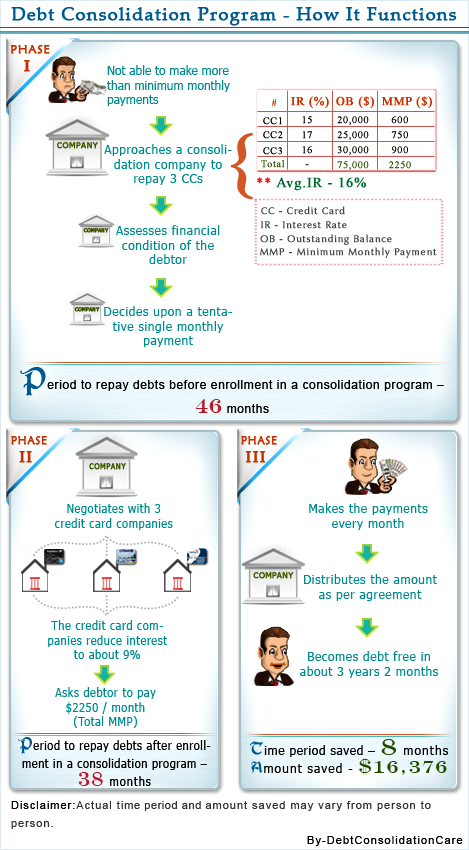

Debt consolidation program helps you pay off your unsecured bills through an easy and single monthly payment plan. This program helps you make only one payment instead of 7 or 8 in every month.

How can these programs help you start a new financial life?

- Help you make lower payment every month

- Help to reduce the number of calls you get from creditors

- Leave you with only one monthly payment plan

- Help you repay your bills within 2-5 years

- Help you improve credit gradually

- May help you knock out the fines and/or late fees

kind of bills can be paid off through the program?

- Credit card bills

- Store cards

- Personal loans

- Medical bills

- Collection accounts

- Other unsecured bills

Student loans Can be paid through secured/unsecured debt consolidation loans

How much

debt consolidation

can save you

What factors do you need to consider before the consolidation of debt?

How do debt consolidation programs work?

Check out these 5 steps to know how do debt consolidation programs work:

- No-obligation free financial analysis – Debt counselors make a thorough review of your income and expenses, along with your debts, to decide upon an affordable amount you can pay every month.

- Sign a written agreement – You can ask questions (such as fees, monthly payment amount, etc.) during the counseling session. If you're happy and satisfied with the session, you can sign up for debt consolidation services.

- Get relief from the creditor calls – Once you've cleared your doubts and signed required documents, the counselor starts negotiating with your creditors to lower interest rates and eliminate late fees. They also put forward the payment plan.

- Make one payment to the company – After the counselors finalize a payment plan, which is accepted by all the parties, you start making the single monthly payment to the company. The consolidation company then disburses the amount amongst your creditors.

- Re-assessment of your financial situation – Usually, after 180 days, the counselor asks you about your financial situation. If it has become worse, notify the counselor so that he/she can re-negotiate a new payment plan with your creditors as per your current situation.

Pros and cons of consolidation

The pros and cons of consolidating your bills are given below.

Pros

Get reduced interest rates

For example, if you have three credit cards at interest rates of 18%, 12% and 9%, then the average interest rate at which you've been making payments is:

(18% + 12% + 9%)/3 = 13%

Say, after consolidation, the interest rates become 13%, 10% and 7% respectively. Now the average rate of interest becomes:(13% + 10% + 7%)/3 = 10%

Now if you owe $5000 on your credit cards, then the reduced rate of interest would save you $150 per month.

Single payment vs many

Positive item on credit report

Debt repayment plan

The plan is developed such that you won't default while in a debt consolidation or bill consolidation program. You'll be able to save dollars and organize your finances better.

Reduction/elimination of late fees

Get debt free faster

Get rid of collection calls

Free debt counseling

Cons

It may take longer to get out of debt:

High fees for program:

How can you get the best debt consolidation program?

- Ask your friends to suggest you a good company

- Find out customers' views regarding the company

- Check out the accreditation of the company

- Get detailed information about the program

- Try to know if the counselors are certified

The right way to choose the best debt consolidation program is to make a comparative analysis of different consolidation companies in your locality. Check out the list of some reliable companies and then compare the programs to choose the best one for yourself.

What are the reasons behind the popularity of online debt consolidation?

- You can get a fresh financial start

- Your payment process can get accelerated

- You can get debt consolidation help 24*7

- Easier for you to make your monthly payments quickly

- You can compare various online companies from your home

- You can get free counseling online and save time

- You may get fast debt consolidation service

Can you consolidate multiple bills for free?

No, most companies do not offer free debt consolidation service. However, here are 2 ways by which you can consolidate your bills for free.

FAQ

Yes, you have an option of choosing which debt you want to consolidate through a debt consolidation program. You may leave out one or two debts, or you can pay all.

Your credit report can tell you if your account is with the creditor or sent to collection. You can pull your credit report from any or all of the credit bureaus such as: www.experian.com, www.transunion.com, and www.equifax.com

Yes, we'll be able to help you even if you have late payments or haven't made any payment at all. Once you enroll for the debt consolidation program, you can pay off the dues and get current on payments.

We value your privacy and assure you that your personal information will not be disclosed to any unrelated third party. Check out our privacy policy for further details.

You need not pay anything for the counseling session. If you are satisfied with the free counseling session, you can avail our services at an affordable fee.

No, the fees you pay to a debt consolidation company are not tax-deductible. Know in detail all the consequences ...

Fewer than 40% of the people who start a debt consolidation program with companies that are not law firms complete it. The success rate of law firms is close to 90%.

While using debt consolidation, all your debts will be replaced with one single debt with lower interest rates. Instead of paying different amounts to different lenders, you will need to make a fixed single monthly payment. This surely helps in simplifying your monthly payments.

Yes, the primary advantages of debt consolidation are the same irrespective of whether you enroll in a consolidation program, take out a consolidation loan, or opt for balance transfer method. However, if you enroll in the program, you’ll get rid of collection calls and complete professional guidance to repay your outstanding dues in full.

Though apparently consolidation helps to improve your score and has a positive effect on your credit reports, yet it can affect negatively too. How? When you opt for a consolidation program and have to make a single monthly payment, that too at a lower rate of interest, you can have a tendency to spend more. This can actually offset the benefits of consolidating debt. So, opting for consolidation is not the ultimate thing. After opting for consolidation, you have to avoid charging your credit cards so that you don’t increase debt. Likewise, if you opt for balance transfer method, you repay the balance at a much lower rate. But, make sure you repay the balance within the low introductory period of the card to avoid paying much more interest on the remaining amount after the period is over. The main idea is that reduce your expenses, save more, and make the consolidated debt payments on time to improve your credit report and score.

You might have heard about the “snowball approach” that many people advocate when paying off debt. When using this approach, a person in debt takes all their bills and outstanding obligations and lays them out side by side, ordered from lowest to highest balance. The debtor then pays the minimum balance on each bill and then puts any surplus funds towards paying off the smallest one on the table. Once the smallest debt is paid, one can then keep moving up the line and gradually tackle larger and larger debts. The hope, of course, is that your debt payments will snowball - that you’ll start small but then gradually empower yourself to move up the debt ladder.

In theory, this is a great logistical and psychological way to approach debt. In reality, however, the snowball method ignores varying interest rates across different bills. After all, your largest bill may have the highest interest rate, meaning that you only stand to cost yourself money by putting it off and paying it last. The method also attempts to break debt into pieces, a move that works for some but may actually leave many people less motivated and less connected to the realities of their debt.

So what debt-reduction solution can counter the snowball method’s deficiencies while also providing motivation? While every situation is unique, debt consolidation is usually a worthwhile effort. Let’s break it down:

- Interest: While the snowball method ignores the importance of interest, debt consolidation usually reduces some individual interest rates by putting all bills on equal footing.

- Psychology: The snowball method gives people an incentive to start paying off debt since small debts are more manageable and less overwhelming. But after each individual debt is paid, the approach creates a natural break after which a person must then muster the motivation to advance to the next level. This can take the wind out of many debtors’ sails. The debt consolidation method, on the other hand, gives people an impetus to start paying (because they can take the easy first step to consolidate) and then it provides motivation to continue (because once you start paying there’s no natural break in the process during which one may stop).

- Perspective: Debt isn’t about individual bills; rather, it is one solitary burden that ultimately reflects money out of one’s pocket. While consumer debt and student loan debt may seem different when each is incurred, both ultimately amount to money lost and numbers on a balance sheet. While the snowball technique obscures this truth by creating different “kinds” of debt, the consolidation approach forces debtors to recognize, acknowledge, and tackle the burden in full. Someone who follows the snowball route may find themselves still incurring small credit card debts because those are easy to pay off. A disciple of consolidation, meanwhile, is more likely to use Green Dot prepaid debit cards and act more responsibly in all areas of personal spending.

These are the main ways in which the snowball method is deficient and where debt consolidation is usually preferable. While this is certainly not true for every person and every situation, it is worth keeping in mind the next time you try to make a plan to motivate and help yourself out of debt.