Video on How to choose the best debt relief optionby Michael Bovee

What can the debt collectors do?

Here's what collectors can do to collect money from consumers:

- They can call you for collecting money

- They can call your relatives for getting your contact details

- They can sue you and garnish your wages

- They can seize your property after getting judgment order from court

- They can report your accounts to your credit report

- They can sell your accounts to other collection agencies

Who are debt collectors and what can they do?

Debt collectors collect past-due or unpaid bills from consumers. They are of 3 types (a) assignee (b) debt buyers (c) collection attorneys. Accounts are often assigned to collectors by the creditors when they are unable to get back money in spite of their best efforts. They get commissions on the basis of the collected amount. Sometimes, collectors buy accounts for pennies on the dollar. On the other hand, creditors sometimes assign accounts to law firms who can sue consumers for fast debt recovery.

What are the 3 types of debt collectors?

- Assignee are Accounts are assigned to them

- Debt buyers are Accounts are purchased by them

- Collection attorneys are Accounts are placed with law firms

Should you negotiate your debt situation with creditors?

We often avoid negotiating our financial difficulties with our lenders. But it can always save you from dealing with the notorious collection agencies.

How to initiate negotiation

- Be preempt in contacting your lenders and let them know your problem. Some creditors, if not all, may empathize with your situation and agree to set up a convenient repayment schedule. Remember that they are more concerned about getting their money back.

- Settle with a lump sum amount if possible. However, the success of a settlement proposal would also depend upon factors like - how much you owe, who's the creditor and such.

- Try to set up a payment plan if you can't come up with lump sum amount for settlement. However, you may have to pay little more for the debt than you would have paid in a lump sum settlement.

Points to remember when negotiating with creditors

- Be committed to your plan: When you have decided to negotiate with the creditor, try to live up to your commitments as bg-white p-4 my-3 border, i.e. donit commit to an amount or plan that you can't meet. If you have decided to settle with a lump sum amount, be prepared to come up with the money upon agreement.

- Ask for settlement proposal in writing: It's always important to get promises written on papers and signed in ink. This precaution is necessary to restrict the creditors from following illegitimate means to collect the debt later on.

- Ask for 'pay for delete': Remember to ask the creditor to remove the negative information from the credit report after the debt is satisfied. The pay for delete request works more effectively with the creditors than collection agencies. Some creditor may agree even to remove the negative information from the credit report upon settlement.

It’s usually said that original creditors are easier to deal with than the collection agencies, as the later often violate collection laws. Also you can save yourself from being sued for the debt by being proactive. Your willingness to repay the debt would put the creditors at ease and they might not sue you for the money.

When can you get calls from collectors?

As per the FDCPA Act, collectors can call you between 8:00am and 9:00pm regarding payment related issues. They should stop calling at your office if you're not allowed to entertain collection calls there. Moreover, if an attorney is representing you regarding this debt, then the collector needs to deal with him.

How can you negotiate with collectors?

Mailing guidelines for contacting creditor and debt collector

- Address the letter to the specific person or department.

- Explain your financial situation including the reason why you couldn't stay current on payments.

- Mention a possible solution to your debt problem.

- Sign your letter.

- Make sure you include your correct contact information in the letter.

- Mention the correct address and return address on the envelope.

- If you can't find the creditor's address, do some research online, look at a letter you've received from the creditor recently, or check out the company's website.

- Attach copies of documents that can act as proof of your financial situation.

- Enclose your letter along with the attached documents in one envelope before you send the mail.

- If you fax your letter along with the attachments, keep a fax confirmation sheet as proof.

- You may use certified mail with return receipt requested. You'll come to know who has accepted the letter and on which date.

- Keep copies of your letter and the supporting documents as proof of what you've sent to your creditors and/or debt collectors.

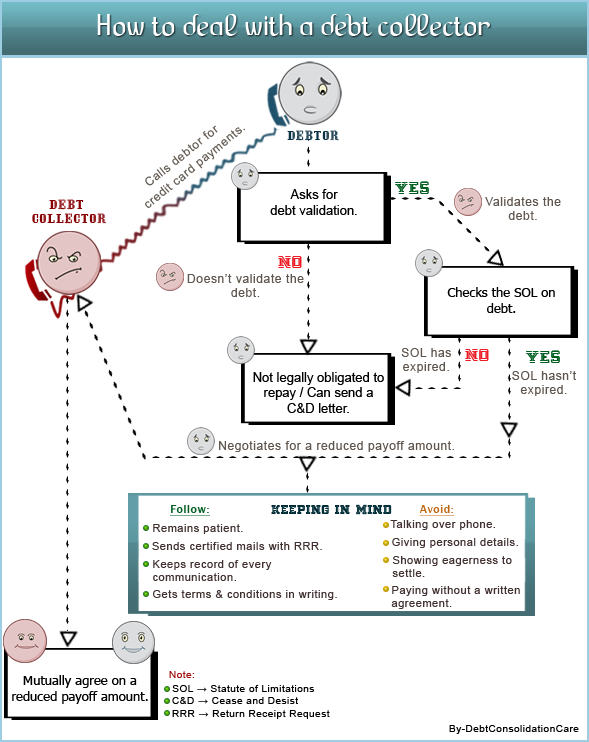

How can you deal with debt collectors?

Check out the following tips and find out how to deal with debt collectors:

Send a debt validation letter to the collection agency via certified mail with return receipt request. This will help you know if the collection agency has been really authorized by your creditor to collect money. Don't acknowledge the debt if you're not the one who owes money.

If the collection agency is unable to prove you owe money, then dispute the debt in writing. You can send a letter via certified mail to the CA and inform them to not contact you again.

You must pay an amount as per the records. Keep records of the conversations you had with collectors. Don't pay money just because you want to get rid of a harassing collector. Sometimes, collectors don't have proper records with themselves. So, keep records of all the documents for as long as you want. It may happen that you get a collection call for a loan which has been paid off 15 years back. The records and documents will be extremely helpful during those days.

Keep separate bank accounts for your Social Security funds and the disability payments. The collector can freeze your bank account through a court-order. It will be very difficult to manage your family budgets during that period. So, keep Social Security funds and the disability checks (which are exempt from garnishment) in separate accounts. At least, you can easily use the money for meeting your expenses.

Shake hands with the collector and negotiate a payment plan on valid debt on the basis of your monthly income. Set up an arrangement which won't make you cross your budget while making payments to the collector. Get help from a credit counselor or a debt negotiator if you can't make payments to multiple collectors on your own.

Don't sit back at home if you're being harassed by a debt collection agency. Search in the Internet and get the contact details of the state attorney general, FTC or a consumer attorney. A good attorney can tell you how to beat debt collectors at their own game. Take legal action against the agency in the event of extreme harassment.

It is important to know about the basic consumer rights in order to deal with debt collectors. For instance, you've the right to ask collectors to validate debt after receiving a collection notice. You also have the right to ask the identity of collector, name of the collection agency, and the debt amount. Know about your right under the Fair Debt Collection Practices Act and find out what you can do if the collectors violate the laws.

Get the repayment plan in writing from the debt collection agency. The plan should be signed by a representative of the agency. This would help you avoid miscommunications regarding the terms and conditions of payment plan in future.

Pros and cons of paying a debt collector via different modes

Pros:

- Cheques: - By paying through cheques you save a lot of money as it's cheaper than any other mode of repayment. You will only have to pay for postage price and certified mail fees to get confirmation that the cheque was received.

- Prepaid cards: By using prepaid cards you just have to load money into that account and use it to spend the money. You can spend only as much as you deposit in your prepaid card. So, it's beneficial as you need not worry about overdraft charges in case the collector over-billed you. Hence, it's a very safe mode of repayment.

- Money orders: You can use money orders as they are of nominal charges and you can easily buy them at post office, grocery stores, bank or credit union, etc. You've to mail the money order, so while calculating charges for mailing you must add postage fees and proof of delivery too.

- Paypal: Paypal is also a common method of transferring money to your debt collectors. By using paypal balance, you can send money without any fees. The amount that you transfer to the collector may have sending limit, you must check your account regarding this. If you've set up a payment plan, Paypal states that you can stop a preapproved payment anytime before 3 working days until it is scheduled to debit from your account.

Cons:

- Bank account draft: When you use bank account draft or auto debit, it means you've given permission to the collector to access the account whenever they wish to. This can create a lot of hassle which can either by accident or design.

- Installments: There is another hidden problem if you decide paying your debts through installments. In case your financial situation changes and there's less money in your account than you can pay, you might be charged overdraft fees. This will only add up to your debts. You are already in the process of repaying your debts and now there can be a new debt to your financial institution for overdraft fees.

- Debit card: Debit card is also an option of paying your collectors but the amount withdrawn from your account can go wrong or there can be more than one withdrawals, instead of what was agreed upon. It may be be difficult to prove that the amount drawn from your account was unapproved, since you have only provided the details of your debit card to the collector. So, it's better to avoid using debit card as a mode of repayment to your collector.

- Credit card: You can also pay your collector through a credit card but that will actually add to your debts, instead of decreasing them. You'll have a new debt and additional finance charges.

- Money transfer: You can also use money transfer as the mode of payment. It includes services like Western Union or MoneyGram, and wire transfers directly from your bank or credit union account to the collector's account. It's comfortable for debt collectors since they can get the payment quickly. Money transfers can be expensive and a risky mode of payment. If you are using money transfer be cautious about the kind of proof you will receive.

What kind of restrictions do they have?

Collection agencies are prohibited from taking some actions while collecting debts. Read below to know about them.

- Making collection calls incessantly

- Using abusive or dirty languages

- Giving false information about the debt or CA

- Threatening to hurt you in any way

- Sending papers that appear to be an official document

- Revealing your debt information to your relative or a third-party

- Pretending to be a government official or attorney

What should you do if collectors file a lawsuit?

Debt collectors can file a legal complaint when they don't receive payments from you. If a lawsuit is really filed against you, then give a prompt response to the summons on your own or through an experienced consumer attorney. Make sure to respond within the date mentioned in the court papers. This will help you preserve your consumer rights.

If collectors are able to prove that you owe money on a valid debt, then the court may issue judgment order. This will empower the collectors to garnish your wage/bank accounts and get back their money.

FAQ

How can we check whether the account is with the creditor or the collection agency?

Your credit report shows all your account details along with the owner of the accounts.

Do debt collectors follow any law?

A federal law known as the FDCPA limits the debt collectors’ actions to harass you. Many states have adopted certain laws to provide protection from the abusive practices of debt collectors.

Does a debt collector have the right to garnish my wage?

A debt collector needs to sue you first, and then win the judgement from the court. The collector can garnish your wage only after that. Moreover, a third party, like your bank, is directed to turn over funds from your account to pay your debt. The debt collector isn’t suppose to harass you to garnish your wage. It’s illegal until a lawsuit is filed.

How can I get debt collectors stop calling me if I’m a victim of identity theft?

You need to show evidence to the debt collector that you are the victim of identity theft, so that the debt collectors stop contacting you. You can show police report, fraud affidavit or letters from companies saying that the debts are not yours. After getting the evidences, the debt collectors need to stop collecting and investigating about the debt. They must inform the original creditor about the identity theft.

Is the debt collector allowed to access my credit report?

The credit history contains very confidential and sensitive information and obviously you don’t want the world to know about it, specially the debt collectors. Companies need to take your permission before requesting for copies of your credit report. However, under few circumstances, collection agencies can access your credit history from all the credit bureaus without taking your consent.

Is the debt collector allowed to contact me even when I don’t think I owe the money?

You must send the debt collector a letter mentioning that you don’t owe any money within 30 days of receiving the validation notice. You must also ask for the verification of the debt and state that the collector must stop contacting you. However, they can contact you again if they have written verification of the debt, you must check the copy of the bill for the amount you owe.

Do I need to pay debts of a deceased relative?

You are not responsible for the debts of your relative who is dead. Though, the debt collectors might not leave any stone unturned to receive repayment from the debtor’s relatives, but, you are not responsible for the debts. However, if a debt collector still contacts you, can send him/ her a certified, return receipt advising the collector to stop all contact. Keep a copy of this receipt. According to FDCPA, a debt collector is not allowed to contact you other than for acknowledgment of your letter or to notify you if take some action, like filing a lawsuit.

Are debt collectors allowed to add fees to my debt?

Under the FDCPA, a debt collector is not allowed to collect an amount more than the debt, until your state laws permit such charges. Moreover, when a debt collector calls you, you can ask for the itemized interest and fees applied to the original debt you owed.

Is there a time limit for collecting debt?

Generally, there are no limits on the time a company can attempt to collect on a debt. However, the statute of limitations may vary from state to state.