Debt buyers - What to do when an account goes in the hands of a collector

- Debt buyers try to collect about 40% - 50% of the debt

- Select the right time to accept a repayment offer

- Know how longer you can extend your payment plan

- Find out how much to project your available funds

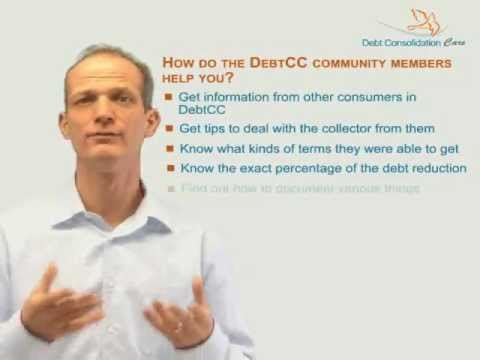

Debt buyers debt purchasers a multi-billion dollar a year industry investors are willing to risk their own capital and buy charged off massively delinquent debt from creditors for as little as eight cents on the dollar freshly charged off six months overdue. The longer a debt has remained unpaid maybe it's been 12 or 18 months and several debt collectors have had your account a purchaser made then buy it for as little as two cents on the dollar half a penny on the dollar. It's a good business otherwise they wouldn't be so large my name is Michael Bovee with debt consolidation CARE and I want to help you avoid some of the pitfalls and traps when you're having communication with a debt buyer. So your original creditor sold the debt they don't own its they don't have a right to collect anymore and you're starting to get collection calls from a debt buyer or an assignee of the debt buyer similar to how creditors will place accounts with assignment debt collectors we covered that in a prior video debt purchasers will do the same they'll send it off to a collection agency who will try and get you to pay as much as they can and they're basically paid by how much they're able to get you to pay so 18/20 % of whatever they collect from you they get to keep debt buyers however behave a little differently see they risked maybe at least in this current environment as much as eight or nine cents on the dollar to purchase your debt and the legal right to collect it they're willing to deal in fact they're willing to deal generally at around a forty and 50% ratio meaning if you owe 10,000 you can often negotiate those debts down to 4,000 or 5,000 what's very unique due to the economic downturn. We're eight years ago 10 years ago debt buyers weren't willing to extend payment plans for a longer period of time in today's environment working out a deal with the debt buyer and structuring the repayment with the balance reduction over longer periods of time makes it much easier for consumers who are just catching back up and you know recovering from a bad economic or financial personal finance event makes it easier for consumers to recover and agree and put this debt behind them so there's some tips some to do's and some definite not to do which account to take advantage of a specific offer or how far to extend the payment plans based on your available finances and what you can project you're going to have for cash flow in the ensuing months sometimes working with a professional is going to be the best idea so that they can help you map out a strategy to deal with more than one account the forum here at debt consolidation CARE is a fantastic place and has been for many many years for you to get information from other consumers who have dealt with that debt buyer dealt with that debt collector. What kind of terms they were able to get what kind of percentage reduction they were able to receive how to get things documented. How to review a document because certainly the number one thing you need to concern yourself with is before you separate yourself with a penny in settling with a collection agency or a debt purchaser is that you get the deal document for now if you do want professional assistance below you'll find a toll-free number you can call and speak with somebody right now there's a chat feature you can engage in a chat with a professional within 60 seconds you'll also see a form fill box where you can submit some very basic information and a professional will be in contact with you.

Are collection agencies harassing you with repeated calls? Are you sure they're legally entitled to collect the debt? Before you make a payment, try finding out if the agencies have the right to collect your debt. This is where debt validation can help you. Check out the topics given below if you want to know what debt validation is all about.

What is validation of debt?

Is there a time limit for validation of debt?

Under the FDCPA, debt collectors (collection agencies or CAs) are required to send you a debt validation notice within 5 days of contacting you to collect a debt. The notice informs you that you have the right to validate/dispute the debt within 30 days of receiving the letter. If you don't dispute the debt (or request validation of the debt) within the 30-day period, the collector has the legal right to assume that you agree the debt is valid.

What details do you get with debt validation?

When you try to validate a debt, the collection agency must provide you with certain details. They are:

You must get written proof that your account has been sold or assigned to the CA.

You'll also get a copy of your current account payment history. This will help you verify the total amount you owe, including any fees being added to your debt. You should also find out how the CA has calculated these extra fees.

This is intended to prove to you that you agreed to the debt. If they do not provide you with a copy of the original agreement, the CA may also provide you with the account statements from the original creditor.

What are the steps in validation of debt?

Check out these 7 steps to validate your debt and deal with collectors and credit reporting agencies (CRAs).

1 Request a validation:

2 Check if the CA is licensed:

3 What if the CA violates collection laws:

4 What to do if the CA doesn't validate debt:

- A copy of your validation letter

- Copy of the return receipt

- A statement that the CA has violated the FDCPA

Under the FDCPA, if the collection agency doesn't validate your debt, then they can no longer collect the payment and they are required to stop contacting you.

5 Sue the collector if listing isn't removed:

6 Remove collection listing:

7 Know how to deal with the CRAs:

Can you dispute the debt after the validation period?

You can send in a validation letter to your CA after the 30-day period, but the collectors aren't legally obligated to reply or stop collection efforts. So, you shouldn't dispute debt after the validation period has expired.

Debt assigned to CA - how does it affect validation?

If your debt is assigned to a CA, they may not be the legal owner of the debt. Sometimes if a debt has been assigned to a CA, it means they have purchased the account from the original creditor and sometimes it means that the creditor has hired the CA to collect the debt for them. When you validate the debt, you should find out how the CA and the original creditor are connected and who has the power to agree to a settlement or payment plan.

How do validation and debt verification differ?

If they validate the debt, the collector is required to send a copy of your agreement with the original creditor. If you are trying debt verification, the collector only needs to provide you with a written statement with the name and address of the original creditor and the total amount you owe. The time you have to verify a debt is similar to the time you have to validate the debt.

With debt validation, you can avoid harassment by collection agencies by verifying whether you legally owe the money. Once the CA verifies your debt, it is easier for you to plan how to pay back the money you owe. Always be sure you know and enforce your rights if the CA refuses to validate or verify the debt.