If you're facing problems to manage your bills properly, then bill consolidation may be your right choice. Attending a no-obligation free counseling session, with a debt relief company, will enable you to understand whether you should consolidate your bills or look for some other options.

What is bill consolidation?

It is a way to consolidate bills into one payment every month. With the help of this option, you can consolidate credit card bills along with your utility bills, payday loans, private student loans, personal loans and other unsecured debts.

How to consolidate bills

1 Bill consolidation program

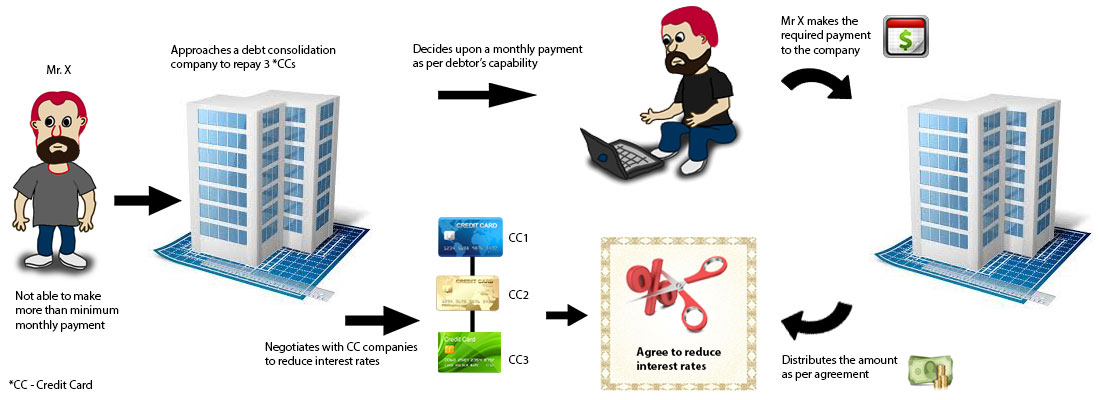

How bill consolidation programs work

2 Bill consolidation loan

3 Balance transfer method

Bill consolidation laws to protect customers

The laws, protecting bill consolidation loans, focus on protecting the regulation of financial institutions, which provide such loans:

- Nationally chartered banks along with few state banks need to be insured by the Federal Deposit Insurance Corporation. The FDIC is a government corporation created in 1933 which protects consumers from problems created by bank failures in 1929.

- The Fair Lending Act and the Truth Lending Act protect consumers by ensuring that all the terms and conditions of bill consolidation loans are provided to customers when they take out the loans.

- The law of the state, where the customer resides, governs the terms of the loan. The amount of interest a financial institution can charge is also governed by the state.

How can bill consolidation help you?

- Reduction in interest rate

- Lower monthly payments

- Stress gets reduced

- Single monthly payment

- Don't have to deal with several creditors

- Do not have to manage multiple bills

- Positive remark on credit report

- Credit score may improve

How much

debt consolidation

can save you

Frequently asked questions (FAQ):

How can you consolidate bills into one payment?

Does bill consolidation hurt your credit score?

However, if your credit rating is good, then you’ll also enjoy favorable terms and conditions on your new credit card and personal/consolidation loan.

How can you consolidate bills with bad credit?

However, you can approach a credit union as they usually offer loans at comparatively low-interest rates.

Is secured bill consolidation loan a good idea?

What types of bills can you consolidate?

- Department store cards

- Credit cards

- Medical bills

- Private student loans

- Personal loans

- Unpaid taxes

- Utility bills

Utility bill consolidation - How does it work?

Is bill consolidation a good idea?

Whether or not consolidation of bills is a good idea depends on 2 primary factors:

- How you’re consolidating bills

- Your current financial situation

How you’re consolidating bills

If you’re consolidating your bills with a loan, then that would lower your monthly payments and give you short-term relief. But in the long run, you might pay more on the interest.

If you want to make one payment for all bills through a program, then it would help to reduce your financial stress. You’re less likely to lag behind your payments owing to the budget-friendly repayment plan. The interest rate and your monthly payments would be lower than what you're paying now.

If you want to consolidate into one bill with the balance transfer method, then that would also give you financial relief. You have to pay 0% interest rate on the balance transfer card. However, you have to pay the total balance (that you have transferred into the new card) within 12 months. Otherwise, you have to pay a double or triple interest rate on the balance transfer card.

Your current financial situation

Bill consolidation is a good idea when your current financial situation allows you to maintain an affordable monthly payment plan until it’s complete.

Be it a bill consolidation program or a loan or a balance transfer method, you have to make payments as per the new repayment plan. Otherwise, it won’t work.

If you’re consolidating your bills with a loan, then ask yourself a few questions first. Some of them are given below:

- Can I afford to make monthly payments if I take out loans to consolidate bills?

- How can I consolidate my bills without collateral?

- What is the terms and conditions of the new loan?

- Is the loan term too long?

If you wish to make one payment for all bills through a program, then ask yourself these questions:

- If I consolidate my bills with a program, then can I stick to the new repayment plan?

- If I consolidate all my bills with a program, then will it help me to save money in the long run?

- Will I have to pay penalties and late fees?

- How long do I need to make payments?

If I consolidate all my bills with a balance transfer method, then ask the following questions to yourself:

- How long is the teaser rate applicable?

- How much is the balance transfer fee?

- Can I pay the entire balance within the promotional period?

The right answers to all the questions will help you understand if bill consolidation is a good idea for you.

Can you consolidate bills online? Is it safe?

Online bill consolidation is an effective way of consolidating bills. It helps you to save time and money. You can complete the entire bill consolidation process online. You don’t have to burn fuel or waste your valuable time. Everything can be done with a few clicks. You can make bill payments online and track the progress of your case 24*7.

Online bill consolidation is safe and secured only when it fulfills the following criteria:

- The website of the bill consolidation company has https:// in its URL.

- The present customers are satisfied with the services of the online bill consolidation company.

- The online bill consolidation company has strong data encryption and privacy policy.

How to consolidate medical bills

The best way to consolidate hospital bills is to enroll in a medical bill consolidation program. This program helps you get rid of unpaid medical bills with an affordable repayment plan. The bill consolidation company negotiates with your creditors to lower interest rates on your delinquent medical bills to make it easier for you to repay them.

Before opting for medical bill consolidation, ask yourself the following questions:

- How much will it cost to consolidate my medical bills?

- When will I be able to get rid of the medical debt?

- Do I have pledge any collateral to consolidate medical bills?