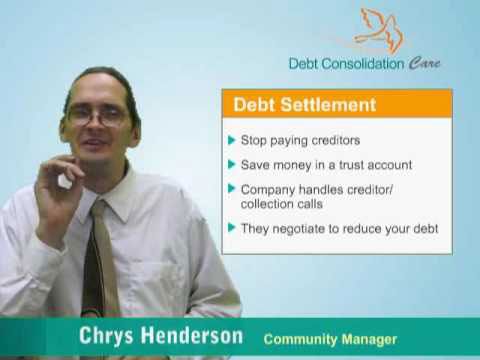

Watch the video: How to settle your debt fast through debt settlement

Debt settlement is best when you:

- Could not make payments for the past 3 months

- Cannot repay your outstanding dues

- Do not want your creditors to file lawsuits

- Want to pay back your creditors

- Want to prevent your accounts from being assigned to collection agencies

What is debt settlement and how does it help?

Debt settlement is a process where you pay less than your outstanding dues. Here, a debt settlement company or you negotiate with your creditors to cut down the outstanding balance. If your creditors don't give a nod to the debt settlement program, you can threaten to file bankruptcy. And, this trick might work for you since creditors would want to recover as much as possible.

Debt settlement plan helps you:

- Settle your credit card debts fast

- Pay less than what you owe

- Save dollars and avoid bankruptcy

- Reduce annoying collection calls

How much

debt consolidation

can save you

When is debt settlement a good idea?

You can opt for debt settlement when:

- You can’t repay debts on your own

- You have quite a bit of debt to pay off

- You are struggling with multiple debts

- You’ve modified your budget but still can’t make your monthly payments

- You have already considered debt counseling and consolidation

- You have attempted to negotiate with your creditors yourself

- You own a home and have gone through the home equity loan option

- You have weighed the pros and cons of bankruptcy

- You want to get rid of debts fast

- You are getting harassing collection calls from creditors and collection agencies

Do you want answers to a lots of questions before choosing this debt relief option? Read this eBook and solve your queries.

How a settlement company helps you in settling your debts

Monthly payable amount

Settlement negotiation

the payoff amount to some extent.

Get rid of one debt

Settle multiple debts

How to choose good debt settlement companies

-

1 Online support:

Problems and doubts may crop up anytime. A good debt resolution company would provide extensive customer support to clients through apps, online chats, phone, emails, instant messages, etc. -

2 Savings:

Though what you save will mainly depend on your debt amount and the creditor, the best debt settlement company should be able to save you a significant amount on your credit card debts. -

3 Transparency:

A good debt resolution company would explain the debt settlement process. The debt negotiators will tell you about their business policy clearly. They will tell you how much you have to pay for settling debts. -

4 Fees:

Good settlement companies charge fees as per the industry standard. They follow the FTC rules and avoid charging any upfront fees. They give a breakdown of fee structure to debtors. -

5 Accreditation:

Companies offering good debt resolution services would be accredited with BBB, the International Association of Professional Debt Arbitrators (IAPDA), the American Fair Credit Council (AFCC), etc. -

6 Proper website:

Good companies offering debt settlement services have a clean website. You can get details of debt settlement services from the website. You can check out the client testimonials, FAQ section, contact details, accreditation, etc. from the website itself. -

7 Reviews:

You should only allow a company to negotiate your debt when it has good reviews. If the clients are not satisfied with the debt settlement service, then there is no point in working with the company.

Make sure the debt settlement program complies with BBB (Better Business Bureau) standards

Checklist of BBB requirements to get enlisted:

- How long the business has been operating

- The number and nature of complaints against the company

- Any licensing or government actions against the organization

- Transparency of the business

It is better if you choose a settlement company that has BBB accreditation. However, if you cannot find one, you can approach a law firm.

Know about some reliable companies or law firms where you can approach.

Settling debts on your own vs. settling debts with professional help

You can settle your dues in 2 ways:

1. Professional settlement services:

There are many debt relief companies that can help you negotiate a deal with your creditor or collection agency. These companies negotiate with creditors and collection agencies to get your unpaid balance reduced. All you have to do is enroll in settlement program and pay a small fee.

2. Do it yourself plan:

This is where you negotiate with creditors or collection agencies to have your outstanding balance reduced. To learn how to negotiate and settle your debts with the creditor or CA on your own, check out this article: How to settle your debts yourself

Settling debts on your ownSettling debts with professional help

NegotiationYou need to decide how much you can pay every month.The settlement company analyzes your financial condition and decides upon an affordable payment.

Mode of paymentUsually you need to make one-time payment towards each of your accounts.You need to pay an agreed-upon amount to the settlement company every month.

FeesYou don’t have to pay anything other than the settlement amount to the creditors.You need to pay a certain amount as professional fees.

How to decideYou want to save more money, but you should have proper negotiation skills to convince your creditors to agree to settlement.You want complete professional guidance to settle your debts, though you’ll have to pay a fee for the services provided.

Pros and cons of debt settlement

Pros:

- Have to pay less - You can get rid of your debts by paying less than what you owe.

- Single monthly payment - If you opt for a settlement program, you need to pay a single monthly amount to the company. And, if you opt for DIY settlement, you can budget and save a substantial amount in a savings account, with which you can settle your multiple debts.

- A suitable alternative to bankruptcy - Avoiding bankruptcy is possible if you opt for settlement. Your creditors and collection agencies may agree for settlement if they think that bankruptcy is the only other alternative if they don’t agree for settlement.

- Debt collectors may stop contacting you - When you opt for professional help or negotiate for a DIY settlement, the debt collectors may stop harassing you for payments.

- Can pay off your debts fast - With the help of debt settlement, you can repay your debts relatively fast.

- Have to pay less - You can get rid of your debts by paying less than what you owe. Thus, you'll save money.

Cons:

- You can’t settle secured debts - As already mentioned, with the help of settlement, you can only repay your unsecured debts such as personal loans, credit cards, etc.

- May have to pay tax - You may need to pay tax on the forgiven debt amount because it is considered as the creditor’s loss and the debtor’s profit.

- It is one kind of gamble - The creditors may not agree for settlement. You can stop making payments for about 6 months and then your creditors might not agree for settlement.

- Credit score may drop - Your credit score may reduce by a few points when you settle your debts.

- Affect credit report negatively - The negative item will stay on your credit report for 7 years.

Check out myths and truths of debt settlement to know the pros and cons in a better way.

Tips to settle the debt for 10 cents on the dollar

- Check the SOL period of your state: Creditors cannot sue you after the Statute of Limitations (SOL) period is over. This means creditors can’t garnish your paycheck or levy your bank account once the SOL period is over. So, you can choose not to settle your debt.

- But, there is one point you need to consider. The debt will still be there on your credit report for 7 years. So, you can’t expect that your creditors will remove the listing from your credit report.

- Check the status of your debts: Creditors are less likely to settle accounts on which you're current. So it would be best to settle accounts on which you are past due.

- Save as much as you can: Debt negotiators can’t start negotiations unless you save a specific amount in the trust account set up by the settlement company. So save as fast as you can in the trust account. This will help you settle your credit card debts quickly.

- Download a debt settlement letter: You'll need these letters at various stages of negotiation. First, you'll need this letter to propose a debt settlement plan to creditors. Next, you'll need another letter to propose what you want to pay in response to the settlement offer made by creditors.

After that, you'll need a letter of acceptance of the verbal offer. Finally, you'll need a proper settlement agreement letter. You can take a print out of settlement letters from here.

Do's and don'ts of settlement

Do's

- A Organize paperwork when you decide to opt for settlement.

- B Be proactive and contact your creditors when you face difficulty in managing any of your debt.

- C Always finalize through written communication and you can take help of sample settlement letters available online.

Don'ts

- A Don’t overlook the effect of settlement while deciding which debt relief option to go for.

- B Don’t opt for a settlement program without shopping around and comparing various settlement companies.

Who should go for debt settlement programs?

Debt settlement programs are a viable option for the people who have various types of unsecured debts such as:

- Medical debts

- Credit card debts

- Collection accounts

- Unsecured loans

- Personal loans

Secondly, most creditors would not accept a debt settlement agreement letter unless you’re suffering from genuine financial hardship. Usually, financial hardship happens due to job loss, overspending, death of a spouse, etc.

Debt settlement programs would work only when you can't pay off debts yourself. You're less likely to be eligible for a debt settlement program if it isn't the case.

FAQ:

- Which one is a better choice - Settlement or bankruptcy?

- How long will it take to settle your debts?

- What will happen to the late fees when you’re settling debts?

- Can you get rid of your medical debt through settlement?

- Can you settle your payday loans?

- Will your wages be garnished if you opt for settlement?

- Can your creditors sue you during the settlement process?

How much should you pay for settling your credit card accounts?

Under the new FTC Rule in 2010, settlement companies cannot charge upfront fees for their services until:

- The debt settlement company has successfully negotiated, settled or reduced at least one of the accounts you have.

- There is a written settlement agreement between you and your creditor.

Under the Debt Settlement Consumer Protection Act enforced by the State of Illinois, the upfront fee is capped at $50 and the total fees shouldn't exceed 15% of what you save under this program. There are additional states that have passed laws recently governing how a debt settlement company interacts with consumers. The fees you pay under a settlement program depend on:

- how much you owe

- the number of accounts you have

- how much you save by settling bills

Why should you read your debt settlement agreement carefully?

Debt settlement can be a true lifeline for people dying from elephantine debt. However, sometimes, even legitimate programs offered by trustworthy companies may have many loopholes and leave consumers with more debt than what they started with at the beginning. This grave doctrine came up when a new report from Center for Responsible Lending(CRL) surfaced. Center for Responsible Lending (CRL) is a nonprofit, non-partisan organization that works to protect homeownership and family wealth by fighting predatory lending practices. According to them, you should always check carefully before getting enrolled in a debt settlement program and must read the terms of the settlement agreement thoroughly before signing.

Genuine debt settlement programs can make huge difference. Usually, debt settlement companies negotiate with your creditors on behalf of you and try to lower the interest rates, principal, monthly payments, and help you set up a payment plan that comes within your budget. Though most reputable companies keep their promises, most don't! According to the report by Center for Responsible Lending, many debt settlement companies first ask you to default on your payments and cease all communications with your creditors so that they can try out in their ways. However, this sudden inactivity leaves a pretty ugly dark spot on your credit score and financial history.

If you listen to what your debt settlement company asks you to do and default on your loan, it'll be exponentially difficult for you to get any loans, credit cards, or financial products in future. Even if you manage to get any loan or credit card, the interest rate will be very high due to your blemished credit history. The worst part is most of the debt settlement companies only promise to try to negotiate with your creditors. And nowadays, many lending institutions refuse to work with debt settlement companies and budge on interest or payments. So once you default agreeing to what your settlement agent says, you just make your situation miserable. Sometimes, such a blunder practically increases your debt, up to by 20%.

You can check out the reportage by Center for Responsible Lending (CRL) via the link below. As per the report, the debt settlement industry needs serious changes, but for people who are looking to get out of the shackles of debt, it might be better for them to make sure the companies they want to work with don't compel them to default on their loans and moreover, don't sell financial services like selling a consolidation loan, which has it's own numerous problems. If things are in bad shape at your end, remember that though it might be a daunting task, you could do it yourself.

Enrolling in a debt settlement program - Get credit after about 9 months of getting rid of debts

Settling debts for less than the balance requires you to be behind in payments. Since about a third of your credit score is factored on repayment history, your credit report and credit score is going to get clobbered! The clobbering itself and the duration of the pain will be different for each person.

Read more...How long it will take to improve will depend on several factors, such as:

- How long you went delinquent before a zero balance was reported

- Was the account charged off (settling debt inside of 6 months delinquency is optimal)

- Was it sold after charge off and re-reported (original creditor reports the charge off and the debt collector reports as well)

- What accounts were current during the settlement process (mortgage, car payment, others)

- What was the depth of your positive credit history (have you had cars, mortgages etc. paid off in the past)

- Did you take prudent steps to rebuild credit along the way

I have worked with individuals who have qualified for FHA funding on a new home purchase 9 months after finishing their settlements (focusing on the above 6 items). The primary reason for this is that your debt to income is in better shape, and the math shows you can comfortably service the mortgage.

This aspect should be considered by those who have been turned down for a modification on an existing home loan based on their DTI, and who have resources that can be creatively deployed.

Industry Expert