Navigating the complexities of debt can be overwhelming. With numerous options available, understanding the nuances of each can empower you to make informed decisions tailored to your unique financial situation.

Debt Settlement

This involves negotiating with your creditors to accept a reduced amount as a total settlement of your debt. This can be done personally or through a debt settlement company.

Pros:

- Potential to significantly reduce the total debt amount.

- One-time payment can free you from debt.

Cons:

- Credit score can take a hit.

- Not all creditors are willing to negotiate.

- Potential tax implications on the forgiven amount.

Bill Consolidation

This strategy involves taking out a new loan to pay off multiple debts. The goal is to secure a lower interest rate or simplify multiple debts into one monthly payment.

Pros:

- Streamlined payments.

- Potential for a lower interest rate.

Cons:

- Securing a lower interest rate isn't guaranteed.

- Risk of accumulating more debt if not disciplined.

Debt Management

Offered by credit counseling agencies, this plan involves negotiating with creditors to reduce interest rates and waive fees. You then make a single monthly payment to the agency, which distributes it among your creditors.

Pros:

- Reduced interest rates and waived fees.

- Structured payment plan.

- Creditors might be more receptive to agencies than individuals.

Pros:

Monthly payment is still required.

Falling behind can jeopardize the entire plan.

Bankruptcy

A legal process offering relief from overwhelming debt. There are two primary types for individuals: Chapter 7 (liquidation) and Chapter 13 (reorganization).

Pros:

- Provides a fresh financial start.

- Legal protection against creditors.

Cons:

- Severe, long-lasting impact on credit.

- Not all debts are dischargeable.

- Public record and potential stigma.

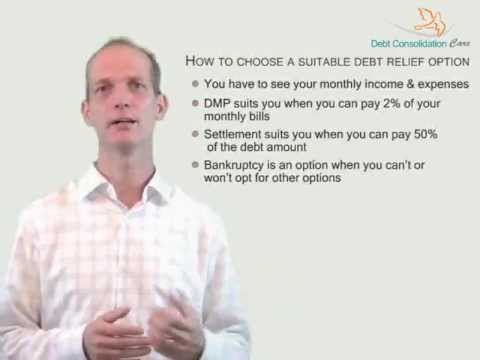

Eligibility

- Debt Settlement: Best for those with a lump sum available and debts that creditors consider uncollectible.

- Bill Consolidation: Requires good credit to secure favorable loan terms.

- Debt Management: Suitable for those with a steady income who can commit to regular payments.

- Bankruptcy: Eligibility varies; Chapter 7 requires a means test, while Chapter 13 requires steady income.

Cost Implications

- Debt Settlement: Fees are often a percentage of the settled or saved amount.

- Bill Consolidation: Potential loan origination fees.

- Debt Management: Monthly fees or a percentage of the distributed amount.

- Bankruptcy: Court costs, attorney fees, and mandatory counseling sessions.

Impact on Credit

- Debt Settlement: This can significantly reduce your credit score, especially if the account is current. :But you can improve it with time.

- Bill Consolidation: Initial dip due to credit inquiry; positive impact if payments are consistent.

- Debt Management: Accounts are often closed, which can impact credit age. Positive if payments are consistent.

- Bankruptcy: Major negative impact, lasting 7-10 year s, depending on the type.

Legal Implications

- Debt Settlement: While not as legally complex as bankruptcy, tax implications can exist. Forgiven debt might be considered taxable income.

- Bill Consolidation: No significant legal implications, but defaulting on a consolidation loan can lead to lawsuits or collection actions.

- Debt Management: Creditors can still sue if they're not part of the agreement or if you default on the program.

- Bankruptcy: Profound legal implications. Chapter 7 may lead to asset liquidation, while Chapter 13 involves a 3-5-year repayment plan. Both types affect your credit report for years.

Case Studies

- Anna's Debt Settlement: Anna owed $30,000 in credit card debt. Through negotiation, she settled for $18,000, saving $12,000. However, she had to pay taxes on the forgiven amount.

- Ben's Bill Consolidation: Ben took out a 5-year loan at 7% interest to consolidate $10,000 of debt from various credit cards averaging 20% interest. He saved significantly on interest over the loan's life.

- Carla's Debt Management: With $15,000 in debt and struggling with high interest, Carla entered a debt management program. Her interest rates were reduced, and she was debt-free for 4 years.

- David's Bankruptcy: Overwhelmed with $50,000 in medical bills and job loss, David filed for Chapter 7 bankruptcy. Most of his debts were discharged, but his credit took a severe hit.

Alternative Strategies

- Snowball Method: Prioritize paying off debts from smallest to largest. As each debt is paid off, funds are redirected to the next smallest, creating momentum.

- Avalanche Method: Focus on paying off the debt with the highest interest rate first, then move to the next highest. This method saves more in interest over time.

- Balance Transfers: Transfer high-interest debt to a credit card with a 0% introductory rate. This can provide temporary relief, but paying off the balance before the promotional period ends is crucial.

Post-decision Steps

- Research: Whether you're seeking a professional agency or going it alone, thorough research is crucial.

- Understand Terms: Before signing any agreement, ensure you understand all terms, fees, and potential consequences.

- Commitment: Stay disciplined and committed to your chosen strategy.

Beware of Scams

- Upfront Fees: Be wary of companies demanding significant upfront fees.

- Guarantees: No company can guarantee specific results, especially before reviewing your financial situation.

- Research: Always check reviews, verify credentials, and consult the Better Business Bureau.

Long-term Financial Planning

- Emergency Fund: Aim to save 3-6 months' expenses to avoid future debt.

- Budgeting: Regularly review and adjust your budget to live within your means.

- Financial Counseling: Consider ongoing counseling or financial literacy courses to build a strong financial foundation.

FAQs:

While the core idea of consolidation remains consistent, your specific strategy depends on your debt type and financial situation.

While debtors can explore various options, the best choice often depends on the debt amount and nature. For instance, if repaying the total debt is impossible, debt settlement or bankruptcy might be the only viable option.

Absolutely. It's crucial to work with a reputable consolidation or settlement company. Ensure they have a good track record, positive BBB ratings, and favorable customer reviews.

Start by educating yourself about each method's pros and cons. This knowledge will empower you to choose the best option tailored to your financial needs.

Eligibility for bankruptcy varies according to the type of bankruptcy. Chapter 7 requires a means test, while Chapter 13 requires steady income.

The fees for each debt relief option vary. Debt Settlement fees are often a percentage of the settled or saved amount. Bill Consolidation has potential loan origination fees. Debt Management has monthly fees or a percentage of the distributed amount. Bankruptcy involves court costs, attorney fees, and mandatory counseling sessions.

Top 4 debt relief programs - 49 Ways to compare and choose the best one

| # | Questions | Interest Rate Arbitration | Debt Management | Debt Settlement | Bankruptcy |

|---|---|---|---|---|---|

| 1 | Will you get free budget counseling? | No | Yes | Yes | Maybe |

| 2 | Does principal amount get reduced? | No | No | Yes | Yes |

| 3 | Does interest rates get reduced? | Maybe | Yes | Maybe | N/A |

| 4 | Does it affect credit score negatively? | Maybe | Yes | Yes | Yes |

| 5 | Does it help increase your credit score? | No | Maybe | No | No |

| 6 | Will it help getting rid of creditor/collection calls? | Maybe | Yes | Yes | Yes |

| 7 | Does it help repay unsecured debts? | Yes | Yes | Yes | Yes |

| 8 | Does it help repay secured debts? | No | No | No | Yes |

| 9 | Can you discharge unsecured debts? | Yes | Yes | Yes | Yes |

| 10 | Can you discharge secured debts? | No | No | No | Maybe |

| 11 | Does it help repay tax debt? | No | Maybe | Maybe | Maybe |

| 12 | Are creditors bound to accept it? | No | No | No | Yes |

| 13 | Does it kill your debts? | No | No | Yes | Yes |

| 14 | Do you have to pay any professional fee? | Maybe | Yes | Yes | Yes |

| 15 | Do you need to pay upfront fee? | No | No | No | No |

| 16 | Can creditor come after you for remaining balance? | Maybe | Maybe | Maybe | No |

| 17 | Do you need to pay any tax? | No | No | Maybe | No |

| 18 | Can you preserve your privacy? | Yes | Yes | Yes | No |

| 19 | Will it help you obtain new loans in future? | Yes | Yes | Yes | No |

| 20 | Do you become debt free within few days? | No | No | No | No |

| 21 | Can you still be sued? | Yes | Yes | Yes | No |

| 22 | Can you incur debt again? | Yes | Yes | Yes | Maybe |

| 23 | Do you need a collateral? | Maybe | No | No | No |

| 24 | Can you repay debts with single monthly payments? | Yes | Yes | No | No |

| 25 | Can late fees get waived off? | Maybe | Yes | Yes | Maybe |

| 26 | Do you have to pay a penalty? | Maybe | Maybe | Maybe | Maybe |

| 27 | Is there any chance of wage garnishment? | No | No | No | No |

| 28 | Does it wipe out community debts? | No | No | No | Yes |

| 29 | Does it remove lien? | No | No | No | Maybe |

| 30 | Does it stop foreclosure? | No | No | No | Yes |

| 31 | Do you need to save money in a trust account? | No | No | Yes | No |

| 32 | Do you need to appoint a lawyer? | No | No | No | Yes |

| 33 | Do you need to sign any agreement? | Yes | Yes | Yes | Yes |

| 34 | Does it provide legal protection? | No | Maybe | Maybe | Yes |

| 35 | Can creditors contact you? | Yes | Maybe | Maybe | No |

| 36 | Can you do it yourself? | Yes | Maybe | Maybe | No |

| 37 | Should you continue using your plastic cards? | Yes | No | No | No |

| 38 | Is it a legal solution? | Yes | Yes | Yes | Yes |

| 39 | Does it help you repay your payday loans? | Maybe | Yes | Yes | Maybe |

| 40 | Does it help repay student loan? | No | No | No | Maybe |

| 41 | Does it help you pay off your medical bills? | Yes | Yes | Yes | Yes |

| 42 | Typical Duration | 1-2 years | 3-5 years | 2-4 years | 3-6 months (Chapter 7) or 3-5 years (Chapter 13) |

| 43 | Average Cost (including hidden fees) | Varies by amount | Monthly fee | 15-25% of settled debt | Court and attorney fees |

| 44 | Eligibility Criteria | Good credit score | Financial hardship | Significant debt | Means test, credit counseling |

| 45 | Typical Success Rate | Varies | 60-70% | 50-60% | 95% for Chapter 7 |

| 46 | Impact on Assets | None | None | None | Possible liquidation |

| 47 | Post-Completion Implications | Improved credit score | Credit rebuilding | Credit score recovery | Long-term credit impact |

| 48 | Potential Risks | Increased debt if not managed | Drop in credit score | Drop in credit score | Loss of assets, long-term credit impact |

| 49 | Updates on Legal Changes | Periodic review required | Periodic review required | Periodic review required | Periodic review required |