What makes you fall into debt? 14 Alarming signs and remedies

Debt is indeed inevitable. Most of us can’t buy a property or purchase a vehicle without taking out a loan. Moreover, debt helps us build our credit score.

But, the question is “How much debt is too much?”

Will it be possible for you to reply to it with a number? Probably not.

Debt is too much when you can’t manage it properly.

14 Habits and decisions which may lead to experience debt problems

Do you think that you have good financial habits and make the right decisions that will help you stay away from debt forever? Even if you plan a budget and try to live within your means, you may have certain habits and may make certain decisions that can lead you to face debt problems.

Check out whether or not you have these habits, which may compel you to worry about debt in the future. Realizing these habits can help you change your habit, if required, to have a financial future without having to worry about debt.

1 Oh, credit cards, the devil you!

You may think that skipping to pay bills for one or two months, but you'll never understand when this will become a habit, and in no time you'd realize that you had piled on debt.

The interest rates on credit cards are comparatively higher; so, if you do not pay your bills every month, you'll have to pay interest on the unpaid amount.

Moreover, you might face problems in repaying debts when you have multiple bills and quite a big amount to pay off.

It is an alarm if you can’t repay your bills at every billing cycle.

2 Using plastic money to buy every item

“You got to have at least one credit card for a good credit portfolio”.

This basic universal truth is manipulated to such an extent that now you need one rewards card, one store card, 50,000 credit cards, one for shopping, one for eating, one for entertainment, one for this, one for that, one for him, one for her, one for you, one for your great-granddad,... And one, and one and one!

Definitely, it helps to build a good credit record if you use your credit cards and repay your bills at every billing cycle. However, this does not imply that you need to buy every item with your credit card.

Studies have found that consumers, on an average, had about 3.06 credit cards in 2017, about 3.04 cards in 2018, and 3.07 cards in 2019. Therefore, it can be said that the figure is somewhat constant.

If you develop the habit of substituting cash with credit cards, then it might become difficult to manage multiple credit cards and you also might not be able to repay the entire amount at every billing cycle.

When even the fundamental needs of life such as foods or gas become unaffordable, it’s the tipping point where you’ll have to reanalyze your budget and make the necessary rectifications.

3 Not having a proper budget

Are you an admirer of Mr. Warren Buffett? That man used to use the old Nokia black and white model even a few years back. Moreover, he also follows a budget and a couple of years back, he said that his personal day-to-day expenses were not more than $200. I think that’s very low for a multi-billionaire!

We should learn a couple of things from him. Remember, rich people have rich money habits.

You are doing a major wrong if you don’t plan a budget. Researchers found that about 67% people have a budget whereas about 33% people don’t plan one. Without a budget how will you know where your money is going?

4 Being extravagant than what you can afford

If you have this habit, then it is quite likely that you'll experience debt problems soon. Therefore, you should always plan a budget so that you can spend according to your means along with meeting your daily and other necessities.

You should allocate a definite amount on each item so that you know when you're spending more on any item.

5 You live paycheck to paycheck

Your American Dream has become costlier and that’s evident from your soaring debts. There are some major living costs, which consumers have to bear regardless of their paycheck amount, like food, housing, and medical care.

Data from popular websites have revealed that in the past 12 years, our living cost has increased by 26.5% whereas, household income grew by only about 7%. Every year, there’s a leap of about 4% - 6% in the living cost. Moreover, studies have found out that in 2007-08, the average living cost increased by about 1% - 2%, even if the income decreased by a couple of percentage points on an average.

A single financial emergency will be sufficient to bankrupt you. So, before you’re struck with a crisis, make sure you have your defenses ready to tackle the unplanned monetary challenges

Spend less whenever possible and work towards generating more income.

6 Not being able to understand what you need and what you want

When you can’t understand what you need and what you want, you can never be a smart guy with finances.

Expenses for ‘things you need’ are utility bills, grocery bills, insurance premiums, and all those without which you can’t sustain your day-to-day livelihood!

While ‘things you want’ are definitely a big house, cashmere clothing, a bottle of french Sauvignon, a PlayStation, etc.!

If you look minutely, you will see that your wants are responsible for your heavy debt amounts.

7 Taking out loans to pay off existing debt

Sometimes people take out a consolidation loan to repay remaining debts. However, if you opt for a consolidation loan or the balance transfer method, then know the ins and outs of the options; also use such options if you think it is the best suitable one, and you'd be able to manage it properly and pay off all debts.

For example, if you opt for a balance transfer method, then be sure that you'd be able to repay the entire balance within the lapse of the low-interest rate period. And, if you decide to take out a consolidation loan, make sure you obtain a low-interest loan so that you'd be able to repay the entire debt with ease.

Let’s have a look at some useful data. Experian conducted a survey on people with at least one personal loan.

- About 26% of the respondents took out a loan to consolidate debts

- About 9% people used a personal loan to refinance existing debts

- About 28% people took out a loan for a large purchase

- About 17% people used a personal loan home improvements

- About 30% took out a personal loan for other purposes

When you take out loans to repay existing debt, you need to repay the new loan too; otherwise, it becomes an additional debt burden.

8 Opting for payday loans to manage your expenses

Data reveals that about 70% of Americans took out payday loans (pdls) to pay utility bills or rents. The interesting part is that about 75% people took out a payday loan who had taken out a pdl before.

About 80% of pdls were taken out within 2 weeks of paying back a previous pdl. And, about 68% people took out pdls to meet their daily necessities.

It is very tough to get out of the vicious cycle of a payday loan trap. If you need quick money for an unanticipated expense, then try to borrow money from friends or family members.

Are you confident that you can pay off the debt by your next paycheck? Well, in that case, ask yourself a simple question.

If you didn't have money to meet the unanticipated expense, then how will you have money to pay off the high-interest payday loan debt?

One payday loan is equivalent to 2 maxed-out credit cards! Remember, payday loans are a great way for wicked and clever people to launder money! I mean who puts an interest rate of 300% and more on loans?

So, the habit of taking out payday loans with the expectation of clearing it on your arrival for the next paycheck is preposterous!

9 Not saving for emergencies as you have less money

This is a good way to welcome debts with open arms. Emergency expenses can crop up at any point in time.

If you haven't saved enough money for sudden expenses, then you can never be in control of your financial life.

10 Going or sending your kids to a costly college without a career plan

You're not making a wise financial move by taking out a huge student loan without a definitive career plan. You can end up getting immersed in the student loan debt sea without having a clue about your career. Unless you know about what to do for a career, keep your expenses under control. Get admitted to a community college or a less expensive university. Make sure you're borrowing less money for college.

Likewise, do not take out an expensive student loan for your kids if you can’t afford it.

11 Buying a costly item only because the interest rate is low

It is a good financial move to buy an item at a low-interest rate. However, buying an item only because the interest rate is low is a financial mistake. If you have extra money, save it for your emergency fund or retirement. You can even use the money to pay down your debts.

12 Telling lame financial lies to your partner

Are you lying to your partner about all that you’re buying? Do you waste your money gambling or excessively going shopping out of leisure?

About 37% of people in our country, on an average, hide a purchase, bank account, bill, etc. from their spouse or partner. And about 18% of people hide debt from their partner/spouse.

If you’ve lost track of your finances, spending recklessly, and on top of that, trying to hide your inefficient money management skills, then you’re ignoring a ticking time-bomb. Apart from that, your foolish monetary exploits may be an indicator of something more deeper than the superficial problem.

Consult a therapist to confirm whether or not your reckless spending attitude is related to your mental health that requires help.

13 Not planning for retirement for several reasons

Retirement planning is important and essential. If you think that you'll start your retirement planning after winning a lottery, then you're perhaps making the dumbest decision of your life. First of all, the chances of winning a lottery are very less. Secondly, you can meet an accident and may have to leave your job all of a sudden.

Have you thought about who will take care of your family in such a situation? Retirement planning is as important as paying off your debts. Give importance to it and save money for the golden years of your life to be stress-free and avoid debt.

14 Hiding your financial hardship from your creditors

Do not hide your financial situation from your creditors when you face any financial hardship. If you're facing financial hardship, then alert your creditors about your situation and request them to lower your credit card interest rates or extend the payment deadline, if possible, for a certain period.

If they agree to do so, it will help you manage your financial situation without falling into debt problems, which in turn, will help you take full control over your personal finance.

14 Alarming signs you’re heading into knee-deep debt

How do you recognize that you're in a debt problem? It's quite tough, though very important to know if you're adding strain on your finances. Remember, trouble always arises after sending a red signal. Many symptoms that can help you to understand if your debts are showing red flags.

Take a look:

1 You've been denied by a lender

If your loan application gets denied several times by the lender, then you can expect that you're crossing the maximum level of debt that you can manage. This is one of the most prime signs that you have a huge amount of debt. Remember, the more debt you have, the far you're from new credit.

That means you're not a creditworthy borrower. You may face problems while applying for another loan. Because your lender will check the DTI and may deny as you can't manage new debts. So, take an inventory of your savings account to know if you've too much debt.

2 You're always late with monthly payments

If you start missing your monthly payments or hardly remember about the payment date that means you're owing too much. You'll be in trouble when paying debt with more debts. Remember, it's the beginning of a problem when you're using one credit card to pay the bill of another credit card.

3 You can’t afford your bills

If you can’t afford the incoming bills months after months, your debt will get out of your hand. It is tough to handle a huge load of debts when you are experiencing some financial hardships like unemployment.

Most debts involve regular, minimum payments. If you are getting the bills, but you can’t pay them off, it’s the time to reduce them at least. Even if you are paying your bills fully but after the due date, it’ll cause you more trouble.

Paying late will generate fines and penalties on your account, and your credit score will be getting lower with the increasing rate of interest.

4 You have ZERO savings in your account

Have you ever noticed, every month, are all your money going to meet the basic expenditure and paying the bills? If so, then your monthly income is blowing behind your debts. You will be pushed further towards debt if there’s a financial emergency.

5 You are thinking more about debts instead of yourself

If you ever think that you're a loser as your debt doesn't allow you to think about yourself. If your outstanding balance is more than your average income then you may face a lot of trouble in personal life.

6 You are creating a strict regimen to kill your debts

One fine morning you've decided to follow an aggressive debt repayment plan to pay off all your debts. This is one of the most major signs; it means you have more debts that you can manage.

But, if you’ve decided to manage debts and pay them off, you’ve made the right decision.

7 You have no idea how much you've gathered as debts

It’s not a big deal whether you have $2,000 debt on credit cards or you have $20,000. The main thing is that you need to know your debts.

If you don’t know how much debt you have, then there’s a possibility that you may increase your debts even more.

If you don’t gather enough funds to pay your debt fully, you should still need to know how much you owe to your creditors.

You’ll definitely need help if you feel that you’ve reached a point where you have ignored debt problems or you don’t know how to keep track.

If you don’t pay the minimum amount regularly, it can affect the credit score badly. Set some time to check all the debts you owe and those interest rates you are dealing with.

8 You have no plans to pay off the debts

Too much debt can hamper your finances, and you can’t do anything to change your situation. You’ll be in big trouble if you feel that you are regularly missing your payments. You must do whatever it takes to pay off those debts by minimum payments or using a tax refund to pay off more. You might have to talk to the lenders and request them to modify the terms and regulations.

If you don’t form a plan, your debt amount may increase day-by-day.

9You are using one credit card to pay another

You will do it wrong if you repay your current debts by using other credit cards. If you’ve to pay with a new credit card, then it is expected that your financial situation is beyond your reach. A new credit card may charge higher interest rates on your new debts. Even if you take out a balance transfer card with a lower rate of interest, you will have to pay a much higher charge if you don't clear the balance within the introductory low rate period.

Also, this option is ok once in a while, but it’s a red signal if it becomes a habit. Also, you can’t regularly borrow cash from your relatives or other people.

10You frequently borrow money from friends and banks.

Suppose, you have taken out a personal loan to pay back a credit card balance worth $6000. You could be hit with an interest rate of around 15% on the new loan for another 3 years or so.

If you’ve got a picturesque credit report, then you can get a personal loan at around 10% rate of interest in the third quarter of 2020. If your credit score is not that good, you may have to pay around 15% or more interest on a personal loan.

Like many people, you may encounter financial hiccups now and then. However, if you see yourself asking for loans from your acquaintances to pay off your debts, and can’t repay them on time or you don’t altogether, then your finances are in a poor state of affairs. It may also ruin your relations.

11Your credit accounts are badly in collection.

Indeed, it is a red signal. Like millions of Americans, you too may need help for your debt problems that you just won’t accept.

A couple of years back, a data published by the Urban Institute after a research, revealed that approximately 1 out of 3 adults (77 million people) have got their credit accounts put into collections, due to payment default. They also studied non-mortgage debts, for example, car loans, credit card bills, parking tickets, medical bills and child support payments.

The debt in collections ranged from as little as $25 to a whopping $125,000. But the average amount owed was $5,200. The credit accounts in collection had an outstanding balance as low as $25 to an astounding amount of $125,000. However, the average debt owed was $5,200.

12Losing a job offer

Be careful and check your credit report and score if you’ve lost a job offer even if you think that you’re worth it.

Several employers go through applicants' credit reports as part of the recruitment process. If you don't know the complete story of your credit report, then you may lose the opportunity to be the finalist. You may face astonishing questions about your credit report about which you don't have any clue. Worse, you may end up losing a job offer just because a collection agency is after you or there are multiple errors on your credit report.

13You can’t live a stress-free life

After knowing and making a plan to repay your debts, you might be still terrified of the coming situation.

If you are constantly stressed due to that huge debt burden and critical financial situation, then that can be painful. Thinking about your financial hardship is natural. But, if it gets on your mind all the time, that can hamper your daily life.

Your relationships with others will be ruined, as well as your health and peace of mind.

Different people act differently in different situations; so, dealing with debt is also different.

However,when you’re constantly thinking about your debts, it makes you fearful and depressed. So, you need to manage your debts or pay your debts as soon as possible.

14 You are suffering from a panic attack

Unmanageable debts may cause mental stress, panic, and even bad health. The constant calls from the creditors can hamper your regular routine (sleep, eat, work, relax). Thus, your health may be affected by always thinking about debts and collection calls.

How can you figure out how much debt is too much for you?

Auto loan debt

Most of the people are of the view that auto loans should be within 5% - 10% of your gross monthly income. You should always buy a car with a 20% down payment and the loan term should be a maximum of 4 years. The more the loan term, the higher you will have to pay on interest.

Student loan debt

Apparently, student loans are supposed to be good loans since they help you get a degree with which you can start or increase your income. However, college students should need to borrow an amount that they can repay with 10% of gross income, and that also depends on what job they get after passing out. So, you have to calculate it accordingly.

Mortgage loan

It is better to cap your overall housing cost to 25% of your gross income. You should save at least a 20% down payment before you start searching to buy a property.

Credit card debt

Now, the most awaited topic - credit card debt. It is not good if you revolve your balances from one cycle to another. Always make a point to repay your existing credit card debt at every billing cycle.

Calculate your DTI

Apart from the above, you can also calculate your debt overload by computing your DTI (Debt-to-income ratio).

Your debt-to-income ratio is good if it’s within 25%; that is, you can spend 1/4th of your income on debt.

Along with that, analyze yourself whether or not you’re able to manage your debts comfortably; that is, you can make the required payments with ease.

Where are you standing?

It can be quite tough to understand whether or not you're in debt. The best option is self-analysis. Thus you can get the most reliable and honest answer. Try to answer the below questions to know your debt situation in a better way.

Here are a few more questions to be sure. Ask yourself:

- Are you a slave of credit cards to meet everyday expenses (groceries, medical costs, etc.)?

- Will you ever blame yourself for any particular purchase?

- Is your spouse having issues regarding bills (phone, utility, etc)?

- Have you started saving for retirement?

- Have you reached the limit of your credit cards?

- Are you making only minimum monthly payments?

- Do you have an idea about your total debt?

- Are you happy with your family life?

- Does the anxiety hamper your profession?

- Does the pressure force you to get drunk?

Think about these questions and you’ll find the answer yourself.

Well, we can say that we have got an idea when it’s alarming to have debt. Now, we’ll have to find a solution to your debt problems.

How can you overcome debt if that’s too much for you?

First of all, tackle it head-on. To do so, you need to have the mindset that you have to get out of debt, come what may.

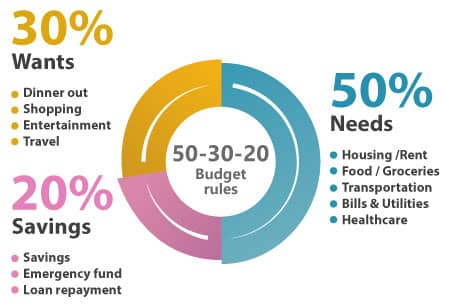

Follow the 50/30/20 rule

As a starter, go for the 50-20-30 budgeting! It’s easy to follow and pretty effective, too. In this budgeting technique, you keep aside 20% of your income for savings; in your case, it can be used for saving for an emergency and making debt payments as it is a big liability.

50% of your salary is to be used for day to day expenses, where you can include your groceries, household bills, etc.

The rest 30% is flexible and you can use it for extra debt payments or extra savings, or if all of your purposes are satisfied, then you can use it for partying and clubbing and whatever your heart wants!

Stop using your credit cards for the time being

One simple rule of thumb, only use your credit card for emergency purposes for the time being!

For your day to day expenses, shift to cash, or use a secured credit card, which is far better than traditional credit cards I believe!

It is advisable not to use credit cards till you repay your last cent of unsecured debt and be current on the secured ones.

Even if you have to use credit cards, promise yourself to repay the outstanding at every billing cycle.

But, if you’re not sure, then it’s better to avoid using plastic money for some time. Where it’s safe to use, you can use debit cards instead.

After you pay off your debt, start using your credit cards responsibly. It will help you increase your credit score.

Set a realistic goal and focus on it

To be debt-free, you need to have a realistic goal in your mind. That is, for example, set a deadline to repay each of your debts.

Also, choose a debt relief method as per your choice.

However, don’t forget to make the minimum payments on other debts. You can choose between debt snowball and avalanche to repay debts on your own.

Adjust your lifestyle

You may have to adjust your lifestyle as per the current financial situation. For example, stop eating out much and cook at home. It’s a healthier alternative, too. Also, stop going for window shopping and meet your friends elsewhere where you won’t be much enticed to spend more.

Have a look at your current budget and check out where you can reduce your spending.

You can follow a frugal lifestyle for some days until you become debt-free.

Sell the stuff you no longer require

Do you have anything which you can do without? If yes, then sell off those items. It may be a piece of furniture, a collection of goods and souvenirs, and use the money to repay debt. Just find out these items and organize a garage sale.

It's easy to deny the problem but hard to accept reality.

Ignoring the problem can't be a solution. Don't try to hide or prolong the problem.

It's advisable to take positive changes as early as you point out your debt problem.

If you’re not able to repay it on your own, you can discuss the problem with the creditor, you can go to the settlement company to get a solution, or file bankruptcy. Where there's a will, there is a way.

You or debt? Who should control your life? Put an end to your habits of being in debt! Make it a motto that you will rule your life and not your debts!

Do not let debt control your life

It might feel that your debts are huge. In other words, it seems that you can never come out of your debts.

But there has to be some way to tackle your debts, isn’t it?

You can opt for professional debt relief solutions to repay your debts under complete guidance.

The good old debt consolidation

Never hesitate to consolidate your debts.

This process is designed by debt relief companies to help you bring your debts together and manage your payments and debts as per your likes!

So, don’t waste much time and think smartly! Consolidation can help you to clear your debts and at the same time maintain a good credit score!

Opting for debt settlement

This is the next option that will sound appealing to you! You have a big chance to settle your debts pennies on dollars.

Get help from a reliable settlement company and the financial advisors will help you out with any queries regarding debt settlement to know whether or not it will be a suitable option for you.

So, go ahead and you can give us a call whenever you want for debt help.

Filing bankruptcy

This is the last resort! To be exact you go for bankruptcy when debts have conquered you and it rules you badly!

Chapter 7 bankruptcy will give you a fresh start by charging off most of your debts, and in some cases, 100% of your debts might get charged off! But it has one problem, your assets might get compromised.

But Chapter 13 bankruptcy is somewhat different and it will give you a debt repayment plan to repay your debts. Here also, some of your unsecured and consumer debts might get charged off!

A few suggestions…

Never become a co-signer for your friend unless you can afford to make payments on the loan. You can never predict the future. If your friend is unable to make payments, then you'll have to arrange money for the loan. Other than that, you'll risk losing your friendship as well as hampering your financial health because of the loan.

Always assess your capability of paying back a loan before opting for it. A creditor or lender might grant your loan request at a higher rate of interest, but it’s ultimately you who’ll have to pay it off.

Final words

That’s all I had to say about taking control of your debts and not the other way around. But remember, it doesn’t mean once you clear your debts, you will not again fall into debts. So, be sensible and learn your lessons for good!