How to plan your finances after paying off your debts

Congrats!! You're now debt-free!

It seems to be a dream come true when you pay off your outstanding debts after rendering years of sacrifice, persistence, and patience. You get immense pleasure and satisfaction after ripping off the last credit card bill.

But, becoming merely debt-free shouldn’t be your main goal. Now you should focus on personal financial planning. You need to have all the financial answers that become useful for managing your future financial life.

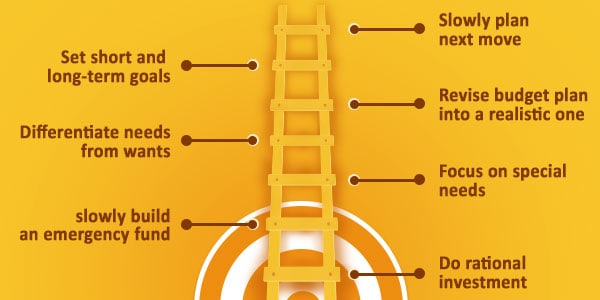

So, now, after you’ve successfully solved your debt problems, let’s talk about how to plan your next move to get a brighter financial future.

1. Slow but steady

It is better not to become impulsive when you’re dealing with your money. Always put your emotions aside and think wisely before spending a single penny. You may have saved a very small amount in your hand since you focused more on paying off your debts.

So, take your time to get used to your present financial situation and plan your next move. Learn from your experience; don’t try to act like the hare, become the tortoise instead. Being slow and steady will help you win the race.

2. Set new goals

Paying off debts has one big benefit. It provides you with immense confidence to go for a new task. You need to keep encouraging yourself to overcome more hurdles.

You might have paid off your huge debts in 3-5 years. So, after achieving such a big success, don't stop there. Pull up your socks and devote 2-3 more to save as much as you can. I’m sure you'll be satisfied with the outcome if you can do a suitable personal financial planning.

Do not be afraid to set short and long-term goals. Often a long-term goal comprises of few short-term goals. Also, take into account the financial goals of your partner and work towards attaining them by helping each other. Team work always gives better results for personal financial planning.

3. Plan a realistic budget

You may think that your nightmares are over now as you have paid off all the credit cards and payday loans completely. So, from now on you don’t require to maintain your old budget plan.

It is true and a misconception at the same time. Ask me how?

Well, it’s a misconception because if you don't follow the rules you’ve maintained earlier during a financial crisis, you can face that same hardship again. And, it’s true, because the same budget won’t work. You’ll have to modify it from time to time to suit your present requirements of your personal financial planning.

A budget also needs to be revised carefully when you experience lifestyle changes like marriage and childbirth.

If you don’t follow a budget, don’t be surprised if you find that an amount is simply "vanishing” amidst your day-to-day expenses.

4. Distinguish between needs and wants

Yes, it is very much required. Also, teach your children from a young age to do this. Often we designate out ‘wants’ as ‘needs’ and spend unnecessarily.

‘Wants’ should not be your priority. When you come across such a situation, simply wait for some days, especially if it’s a big-ticket item. Then, even if you feel the urge to buy that item, check out whether or not you’ll be able to afford that without hampering your finances. Then, make yourself a last question, will you feel guilty after buying that stuff? If yes, give yourself more time to make the decision.

Keep your hard-earned money for the things you truly care for. It will give you more satisfaction and happiness.

5. Prioritize your special needs

Since the past few months you are devoted to paying off your debts. So, it’s quite possible that you’ve neglected some major projects during that time. It may be buying a car, opting life insurance policy, funding your child’s education, or saving for a vacation. Now, it’s your chance to put money aside for those things you neglected. Retirement savings and emergency funds are the two most important things, which we normally ignore. The experts say that you should start financial planning for retirement from the month you get your first paycheck. So, at least focus on it now since you’re debt-free.

6. Create an emergency fund

Perhaps you wouldn’t have fallen into debt if you would have an emergency fund. So, give importance to it and include this in your financial plan.

Try to have about 3-6 months worth of your living cost in this emergency fund. And, make sure you use these funds just for emergency purposes. Once you use it, try to replenish it asap.

Doing so, you’ll also be tension free that you’re equipped to tackle a financial emergency.

7. Invest WISELY

If you decide to invest your hard-earned money in a new business, this is the right time to do it. You have a new, freshly optimized credit score, and a good amount in hand. So, keep searching for new ways of utilizing your capital and make more money. Buying real estate, investing in construction work, stocks and many more can be your main preferences.

Paying off your debts needs extraordinary patience, so don’t fall for any lucrative offers which can ruin your future financial life. Always remember and learn from your experience and make your financial plan accordingly. Always try to manage a proper budget and pay your utilities on time. Fetch your credit report and search for any remaining error there. If you find out any dispute in your credit report, make sure to inform the bureau about this and get it removed from your credit report..

Follow these things, have a good financial plan, and have a rocking financial future!

Read on: Which basic factors motivate you to manage your finances?