Are you feeling weighed down by massive credit card bills? Are you getting collection calls from creditors every day? If so, then this is the best time to consolidate multiple debts.

How does credit card debt consolidation help you?

- Lowers interest rates and makes monthly payments affordable

- Replaces multiple credit card debts with a single monthly payment plan

- Helps you get rid of credit card late payment fees and other penalties

- Helps you keep track of your debt progress and get financial success

- Helps you avoid bankruptcy and protect credit score

What can you do before consolidating your credit card debts?

1 Call 800-DEBT-913

Explain your credit card debt problems in the FREE no-obligation counseling session to an experienced financial counselor. Keep all your credit card bills in your hand before making the call.

2 Admit how much you can pay

Give a rough idea to the counselor on how much you owe on your multiple credit cards and how much you can pay every month. You can use an online credit card payment calculator for calculating all the figures.

3 Get credit card debt advice

The financial counselor will tell you the credit card debt consolidation process in detail online or over phone. He will tell you how much you have to pay to be debt free.

How does credit card consolidation help you repay debts?

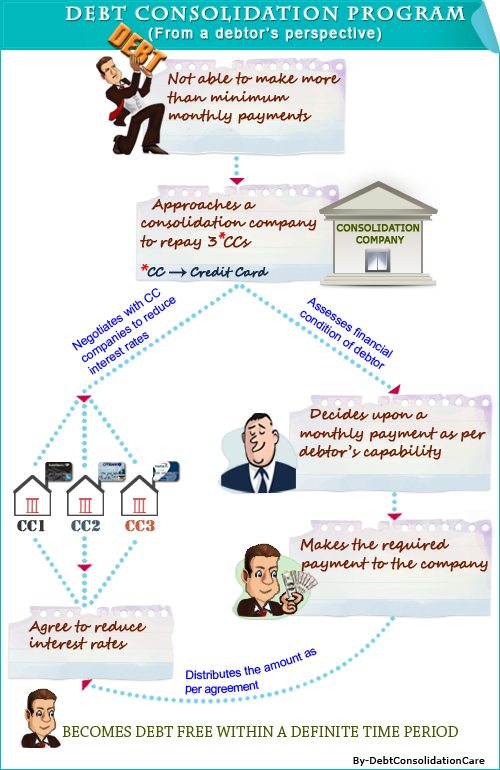

With the help of credit consolidation, you can restructure your debt repayment plan. Through this, you can consolidate your multiple credit card bills into a single payment every month. Thus, you need to manage only one payment instead of handling several creditors.

However, the amount you need to pay every month will depend on the following:

Current interest rates on your debts

Your total outstanding balance

The amount of your monthly income

Your creditors

How much

debt consolidation

can save you

How will you know that credit card consolidation is suitable for you?

Check out these factors before you opt for this credit card debt eliminate option:

How does credit card debt consolidation affect your credit report?

Usually, there is a positive effect on your credit report when you consolidate credit card balances since you pay back your debts in full. So, you’re not only getting financial freedom by consolidating credit card debt but also improving your credit score gradually.

What are the differences between credit card consolidation and settlement?

Credit card debt settlement is also a suitable option to get rid of debts. However, there are some differences between consolidation and settlement, which are given below.

| Characteristics | Credit card consolidation | Credit card settlement |

|---|---|---|

| 1. Reduction in principal amount | ||

| 2. Reduction in interest rate | ||

| 3. Lump sum payment | ||

| 4. Single monthly payment | ||

| 5. Free counseling | ||

| 6. Trust account is created | ||

| 7. Effect on the credit report - "Paid in Full"* | ||

| 8. Effect on the credit report - "Paid as Agreed"** |

* Paid in Full - It means that the debtor has paid the outstanding balance in that account in full.

** Paid as Agreed - It means that the debtor has paid the amount requested to satisfy the account.

What are some other credit card debt solutions?

Credit card debt settlement

Here you settle your credit card balances by paying less than what you owe. You can pay the agreed amount up front or in lump sum and be debt free.

Credit card debt management

Here a credit counselor will review your finances, offer a budget plan and then negotiate with your creditors to cut down credit card interest rates.

Bankruptcy

This is a legal solution to your credit card debt problems. Here, the court decides a payment plan that you need to follow to pay back your creditors.

Credit card consolidation - A bankruptcy alternative

Check out the differences between bankruptcy and credit card consolidation:

| Sl No. | Questions | Debt Consolidation | Bankruptcy |

|---|---|---|---|

| 1. | Does interest rates get reduced? | Yes | No |

| 2. | Does it affect credit score negatively? | No | Yes |

| 3. | Does it help increase your credit score? | Yes | No |

| 4. | Does it help repay tax debt? | No | Yes |

| 5. | Does it help repay unsecured debts? | Yes | Yes |

| 6. | Are creditors bound to accept it? | No | Yes |

| 7. | Do you need to appoint a lawyer? | No | Yes |

| 8. | Can you still be sued? | Yes | No |

| 9. | Does it provide legal protection? | No | Yes |

| 10. | Can you do it yourself? | Yes | No |

| 11. | Can you repay debts with single monthly payments? | Yes | No |

Is there only one way to consolidate credit card bills?

No. There are 3 ways to consolidate your multiple credit card bills. They are:

- Credit card consolidation programs: This is the best way to consolidate credit card debt since you don’t have to worry about anything. The credit card consolidation company would negotiate with creditors, bring down interest rates, and deal with the collection calls.

- Do it yourself credit consolidation: Here, you negotiate and convince creditors for a lower monthly payment. You can also transfer balance from a credit card with high-interest rate to one with low-interest rate (known as credit card balance transfer) so that you have to pay less every month.

- Credit card debt consolidation loan: This is a risky option since you use an unsecured or secured debt consolidation loan to consolidate your credit cards. You use the money to pay off your credit card debts and then make a monthly payment to repay the personal loan.

When does it make sense to repay old credit card debts

There are certain situations when it makes sense to pay off your old credit card debts. For instance: when you want to avoid creditor harassment, when you wish to improve your credit, when you desire to flourish in your career, etc. Read along to know about the circumstances when it makes sense to repay your old credit card debts.

- When you genuinely want to improve your credit record: You may not get sued for an old delinquent debt if it has crossed the statute of limitations (SOL) period in your state. The SOL period in most states stretches between 3 and 6 years. If the SOL period on your debt has expired, then it has become time-barred. You won't have to worry about the legal hassles. However, the listing will be there on your credit report for 7 long years. The delinquent status of the account hurts your credit score. So, getting out of the old delinquent debt is certainly in the best interest of your credit.

It is true that the item will not go away from your credit report even after the debt is paid off. However, the updated account status will increase your creditworthiness. This would be helpful when you're applying for a loan or a line of credit. - When you wish to obtain low interest rate on a loan: Paying off the old debt makes sense when you wish to obtain low interest rate on a loan. Lenders may agree to offer a low interest on a loan after seeing that you've paid off an old debt. Old and unpaid debts harm your credit. However, the impact becomes less with time. Your credit score won't increase by a huge margin after paying off an old credit card debt. Still, the credit scoring models will look at you approvingly after a delinquent debt is paid off. Moreover, a lot of lenders check the credit report of the borrowers before giving out a loan. They may not like the borrowers who have not bothered to clear their old debts.

- When you want to get a job: An unpaid old debt may prevent you from getting a job in accounts department. Many employers check the credit report of job seekers and delinquent old debts send red signals to them. If you wish to get a job in accounts department, then its best to repay your delinquent debt, even it is time barred. Employers may not prefer to recruit people who can't manage finances efficiently, especially in the accounts department.