The debt problem is the most familiar issue in our nation. The consumer debt is skyrocketing day by day. According to the Federal Reserve, the average American households are in $133,568 debt including credit card debt, mortgage, car loan, etc.

But when it comes to paying off debt, people become confused because they get numerous advice.

Some people suggest debt consolidation, whereas some think paying off the high-interest debt first is a great idea.

Well, choosing the best repayment option based on your financial situation is advisable.

How will you choose the best repayment options?

The 2 most effective DIY debt reduction methods are debt snowball and debt avalanche.

You can pay off your credit card debt debts, car loans, private student loan, and personal loans by using these methods.

Here is the detailed analysis of debt snowball and debt avalanche methods that will help you to choose the right one to pay off your debts.

What is the debt snowball method?

The debt snowball method was first described by the financial guru Dave Ramsey. Later, it was followed and was appreciated by many people as suitable debt payment strategies.

In the debt snowball method, you need to arrange debts from the smallest to largest outstanding balance (OB), regardless of interest rates.

You need to make larger payment to the smallest debt while paying the minimum on the rest of the debts.

Once you pay off the smallest debt, start making larger payment to the second smallest one while paying the minimum on other debts. Follow the method until you pay off all your debts.

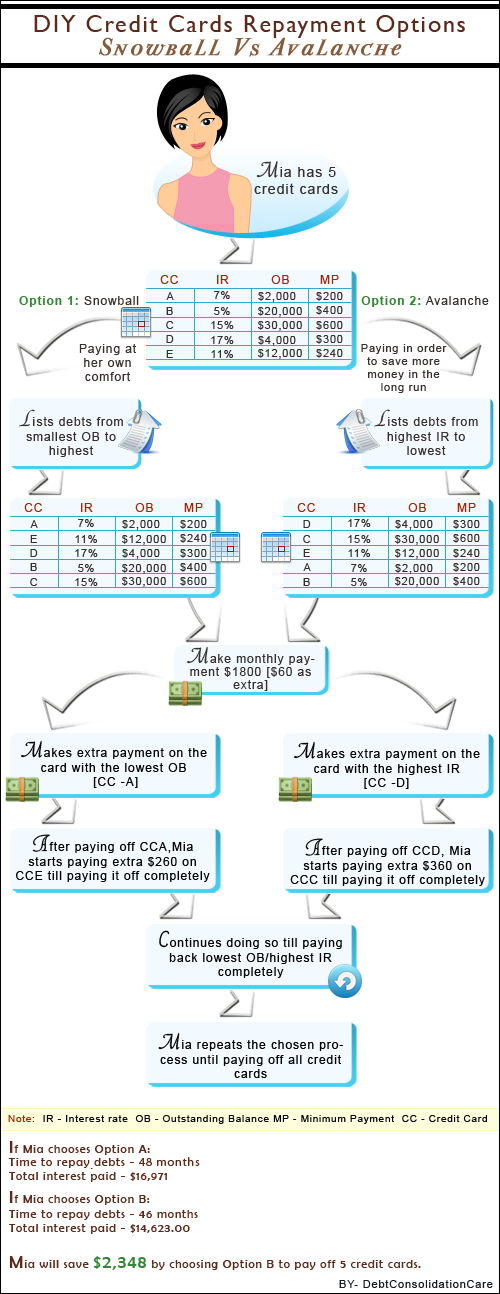

As you see in the infographic:

- Mia has listed her 5 credit cards from the smallest to largest.

- To do so, you may need to open a Google doc or a sheet of paper to list all your debts (credit card debts, medical debts, private student loan, etc.) from smallest to largest balance.

- You need to make minimum payments on all your debts while paying a larger amount (as much as you can) to the smallest debt amount.

a How does the debt snowball method work?

| Credit card | Interest rate | Outstanding balance | Monthly payment |

|---|---|---|---|

| A | 7% | $2,000 | $200 |

| D | 17% | $4000 | $300 |

| E | 11% | $12,000 | $240 |

| B | 5% | $20,000 | $400 |

| C | 15% | $30,000 | $600 |

As you see in the infographic that Mia has arranged her credit cards from smallest outstanding balance to the largest.

Now, she has to make minimum payments (as mentioned in the infographic) on all credit cards, including say $60 extra to the lowest outstanding balance credit card (Credit card-A) till she pays it off.

She has to pay $1800 monthly payments [$60 as extra] every month.

Once the credit card A is completely paid off, she needs to target the second highest outstanding balance credit card, i.e credit card D.

She has to follow the same rule until she repays all her credit cards.

b Advantages of following the debt snowball method

- The debtor can easily set the target debt and start working on that.

- Starting with the smallest outstanding balance can help you to pay off your debts easily.

- After paying off the smallest debt, you will have more free money to focus on the next debt on your list.

- As you will get the quick win, you will feel motivated and a sense of confidence will grow in you.

- Many people have already tried this method and got positive results.

- This method is best for people who are struggling with the stress related to their unpaid debts.

c Disadvantages of following the debt snowball method

- Since you are targeting the lowest balance regardless of the interest rate, you may end up paying more in interest over time.

- This process will take a long time to get completed. In short, it will take a long time to pay off all the debts.

What is the debt avalanche method?

Debt avalanche method is a bit different from the debt snowball method.

In this method, you need to arrange your debts from the highest interest to the smallest interest debt.

In the infographic, see how Mia has arranged her debts:

- You have to make the larger payments to the highest interest rate debt while paying the minimum on the rest of the debts.

- After paying off the highest interest rate debt, you need to focus on the second highest interest rate debt and start making the larger payment while paying the minimum on the others.

- Follow the method until you pay off all the debts.

a How does the debt avalanche method work?

| Credit card | Interest rate | Outstanding balance | Monthly payment |

|---|---|---|---|

| D | 17% | $4,000 | $300 |

| C | 15% | $30,000 | $600 |

| E | 11% | $12,000 | $240 |

| A | 7% | $2000 | $200 |

| B | 5% | $20,000 | $400 |

As we see in the infographic that Mia has arranged her credit cards from the highest interest rate debt to the lowest.

Now, she has to make minimum payments ($1800) on all credit cards including paying $60 extra to the highest interest rate credit card (Credit card D) till she pays it off.

After paying off the credit card D, she has to pay extra to the credit card C while paying the minimum on the rest of the debts. She needs to follow the same rule until all the debts are paid off.

b Advantages of following the debt avalanche method

- You can save money on interest as you are targeting the highest interest rate debt first.

- You can get rid of your debts quicker than debt snowball as you are paying off the toughest and the highest interest rate debt first.

c Disadvantages of following the debt avalanche method

- You may lose motivation while following this method, because you have to work on the highest interest rate debt first, which takes a longer time to repay.

- You have to earn more to make larger payments. If you don't have enough cash flow, you may not be able to manage it. Because you have to make larger payments to the target debt (the highest interest rate debt).

- Initially, you may feel like you will never be able to get rid of the highest interest rate debt, since it will take a longer time to pay off. But, once you pay off the first one, the overall time will gradually decrease because the interest rates on other debts are relatively less.

Debt snowball vs. debt avalanche

- By following the debt snowball method, you will get a psychological boost.

- Debt avalanche method takes a relatively longer time to pay off the highest interest rate debt.

- Debt avalanche ends up costing less money. But, snowball ends up costing more.

- Both methods are ideal for tackling multiple debts.

- You need to make extra payments to the target debt.

- You are required to earn extra money to manage these methods. Otherwise, you may not be able to make larger payments to the target debt, which is mandatory.

- You can also adopt a frugal lifestyle to save more to make extra debt payments.

What should you do to choose the right method to repay your debt?

The truth is, choosing the right method depends on your financial situation.

If you want to save interest payments over the time of your debt payment, then debt avalanche is best for you.

But, if you want a quick result in reducing the number of debts, then snowball is for you.

How do you know which method is best for your financial situation?

1 Use debt snowball vs. debt avalanche calculator

To understand which method is perfect for you, you can use a calculator.

You can find snowball vs. avalanche calculator online. Separate debt avalanche and debt snowball calculator are also available on the Internet.

The calculator will help you to determine:

- How much you can save in the interest payments by following avalanche method

- The total cost of following the snowball method

2 Use spreadsheet templates

Using a spreadsheet can help you to manage the debt snowball or avalanche methods. Spreadsheet templates can be used with Google Docs, Microsoft Excel, or Openoffice Calc.

You just need to download the template and apply the method described earlier.

Put the numbers (debt amount) in the spreadsheet and let it do the calculation for you.

You can get free debt snowball worksheet and debt avalanche spreadsheet or worksheet available on the Internet.

How can you make larger payments toward your target debt?

Be it debt snowball or debt avalanche method, the key is making larger payments to the target debt. To do so, you should have a good cash flow.

If your current income is not enough to make the larger payments to the target debt, you should try to increase your total income.

Here is what you can do:

- Revisit your budget to eliminate unnecessary expenses

- Consider a part-time job to earn extra

- Consider frugal living to save more

Well, creating a debt reduction plan and the process of getting out of debt can be daunting. You need to work hard and restrict all the cravings for impulsive spending. However, you shouldn't deprive yourself throughout the debt payoff process. Celebrate the small win of getting rid of debt one by one. You will feel motivated and focused on your debt repayment goal. Good luck!

5 Scenarios and solutions to repay the last cent by using snowball and avalanche

It is always better to pay off your debts all by yourself without any professional help. By doing so, you can save the money that you otherwise need to pay to an organization and also you can repay your debts at your own pace. Here are 4 scenarios and solutions from which you can select one that resembles your current financial status, and can follow the specific strategy to get out of debt completely.

Scenario 1: Every month you check your credit card statements and see that you're paying quite a lot towards the interest. So, you want to get rid of your debts really fast in order to save money.

Scenario 2: You have quite a few unsecured debts to pay off. You have tried to repay them on your own but you lack motivation since you think it'll take quite a long time to pay them off.

Scenario 3: You have several bills to pay off and you want to stay motivated and repay the last debt in your list. You have a stable income and you think you can save a good amount every month after meeting your daily necessities.

Scenario 4: Amongst your debts, some are of really low balance while some others have lump sum outstanding balance. You have a stable income but now you can't save much but you're sure to get an increment in some months of time.

Scenario 5: You are aware of debt snowball and avalanche and you can motivate yourself to repay till the last cent. However, you cannot decide which one will help you financially in the long run.

In all the above situations, the basic thing is you need to budget and save money so that you can contribute more dollars towards paying off the bills. So, save money, choose debt option(s) that's best for you and take control over your financial life the way you want.