4 Things you should know when filing bankruptcy in 2011

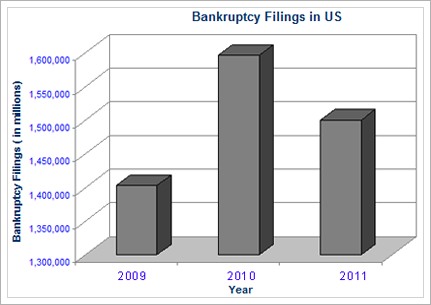

The number of bankruptcy filings in on rise since the American economy was hit by recession in 2007. It is reported that the officials at U.S court received around 1,596,355 bankruptcy petitions in the fiscal year 2010. The total number of bankruptcy petitions in the year 2009 was 1,402,816. Financial experts are expecting that nearly 1.5 million consumers will file bankruptcy in the year 2011.

If you are one of those who are thinking to file bankruptcy in 2011, then you should start planning for the life after bankruptcy. The reason is, bankruptcy hurts your credit big time. Apart from that, lenders and the employers look down upon the consumers who have filed bankruptcy. So, it is important to think about the ways to repair your credit prior to filing bankruptcy. Read along to know about the things to know when you're planning to file bankruptcy.

Things to know while filing bankruptcy in 2011

Here are the 4 things you should be aware of when you are planning to file bankruptcy in 2011:

1.Think about a suitable explanation: Most consumers file bankruptcy due to 4 main reasons – job loss, marital separation, sickness, and unmanageable debts. When you'll apply for a job or a loan, your future lenders and employer will ask you why you had to opt for bankruptcy. You have to justify your action that time. Explain to them that you had to go for bankruptcy due to financial hardship. However, you are taking steps to manage your finances effectively.

2.Go through your credit report: Check your credit report and try to remove the negative items appearing on it. Of course, you can clean up your credit report of only those items that can be legally deleted. This will convince your future lenders and employers that you are taking steps to manage your finances effectively. Don't forget to check whether or not your contact details are correct on your credit report.

3.Know when negative items can be removed: You should know that the negative items don't remain on your credit report throughout your life. They can be deleted from your credit report after a certain period of time. For instance, late payments stay on your credit report for 7 years. So, you should get to know about the date on which the negative item is ready to be eliminated from your credit report.

4.Take advantage of secured credit card: You can take advantage of secured credit card to re-establish credit line. You can get a secured card from a credit union. You just need to give $500 to the credit union for obtaining a card. Once you get the card, report it to the 3 credit bureaus – Equifax, TransUnion, and Experian.

Finally, bankruptcy lowers your credit score by around 200 points. However, with time, patience and smart financial planning, your score will improve. If you had a good credit score few years back, then make it a goal to achieve it again. Check your current credit score and take steps to achieve your goal.