A debt-free lifestyle requires less effort than what you actually think. All you need to do is select the right way to pay back your creditors. Once you start living a life without an escalating credit card balance or frequent calls from collection agencies, you can get back the peace of mind.

How to take the initiative of being debt free

The financial advisors say that the main reason why people are in debt is due to the fact that they want to be in debt.

To become debt free, the first thing you need to do is make a decision, deep within yourself, that you want to overcome your debt problems.

However, once you decide that, be prepared to face a lot of criticism. But, you’ll be successful only if you stick to the decisions you’ve made, and don’t pay heed to what others say.

Whatever be it, you need to get out of debt, because debt can lead to marital problems, health issues, and invite several other problems in your life.

You can motivate yourself by thinking - What happens when you’re debt free? Have you thought of it?

Apart from improving your financial situation, once you’re out of debt, your confidence level increases dramatically. Money gives power.

When you know you don’t owe anything and you have a decent amount in your savings account, you know you have the monetary power, which makes you confident in life.

So, take the initiative! Be debt free and enjoy life!

How your life can be better when you are free from debt

Before you know the steps and tips about how to get debt free, first discuss in what way life is better when you have no dues to pay off.

You can live stress-free - Why have more stress when we have to deal with so many tensions in our life? When you don't have to worry about debt, your life becomes stress-free too. Even if you meet with an emergency financial situation, if you have an emergency fund, money can be used to sustain without giving a major blow to your financial situation.

Better control over your life - When you don’t have to arrange money for the interest payments, you have more cash to have a better control over your life. Instead of paying for your past expenses, you have money to use for your present and future needs. Moreover, you can also invest for a better return in the future.

You can plan a better future - A debt-free lifestyle helps you plan your future in a better way. When you make just the minimum payments, the payable amount gets piled up and creates an avalanche, thus making it more difficult day by day. But, you can build a positive avalanche by paying back your outstanding balances. Doing so, you can secure your financial future, too.

How to become debt free - 10 Simple steps to follow

You can just forget about living without debt unless you accept your fault. You're in debt problems because of the following reasons:

- You've borrowed recklessly

- You've missed out your payments

- You didn't save money

- You've ignored your creditors

- You didn't have any control over your expenditure

It is difficult to avoid debt without any strong resolution. Promise yourself that you'll be living debt free after a specific period of time. Once you've set up a goal, start taking steps to achieve it.

It is high time you know how much you owe to your creditors. Go through the unopened and opened bills. Make a list of your bills, from big to small. Calculate your total debt amount. Don't forget to note down your net monthly income. This will help you understand where you stand financially.

You have how much to pay your creditors. Now, you have to decide on the payment strategy. Ask yourself if you can negotiate with your creditors and pay them back on your own. You can check out the DIY section for any assistance. However, if you're not confident about handling your creditors, then it's better to seek professional help.

A professional can tell you how to live a life without debt problems. He/she has the knowledge and the expertise to help you out. Discuss your financial situation with the professional. Don't hide any fact or else the professional won't be able to guide you properly.

A professional can help you choose the right option. If your desire is to lower the interest rate on your credit cards, then enroll in a consolidation program to pay back your creditors through affordable monthly payments. However, if you wish to bring down the outstanding balance, then you can go for the settlement program. Choose the right debt free plan to live life without debt after a specific period. But, you'll have to stay motivated and make the required payments on time.

Attend the free counseling session offered by the debt relief company. This is the time when the professional will ask various types of questions to you. Answer each question correctly. Mention the name of your creditors and the amount you owe to them. Make sure you inform the professional about your interest rate and minimum monthly payment amount so that he/she can make the best decision.

In case of a consolidation program, the professional will also help you plan a budget. You'll have to adjust your lifestyle to fit into that budget. The professional would like to know the amount you can save through budgeting.

In a consolidation program, the professional will explain to your creditors why you can't pay the high-interest rates anymore. The professional would request the creditors to allow you to pay back your dues through affordable monthly installments.

If you opt for settlement, then the professional will request your creditors to cut down your total payable amount. He/she will request the creditors to settle debt through a lump sum payment.

Start making payments on the basis of the option you've chosen. If you're working with a consolidation company, then send single monthly payments to pay back your creditors within a period of 2-4 years. On the other hand, if you decide to pay off your debts through a settlement company, then start saving money in a trust account. Once you have saved a lump sum amount, the professional will contact your creditors and hand over the money.

You can't afford to lead a luxurious life when creditors are knocking at your door for payments. You have to get accustomed to a modest life. Buy a cheaper brand of items to save money. Resist your temptation of dining at expensive restaurants. Rent DVDs to watch your favorite movies. The idea is to save as much as you can.

Try to do extra work to earn more and get debt free. You can work for some extra hours at your office to make money. Otherwise, you can also do side jobs in your free time. You can work from your home to make some serious money and pay off your dues.

Being frugal always helps when you want to live debt free now and forever. But you shouldn’t be selfish when you’re practicing to live debt free. So, knowing how to draw the line between being cheap and frugal is important.

Keep your credit cards at a safe place. Use cash to make your purchases instead of whipping your cards. Reject the new credit card offers, no matter how much tempting they are. Avoid borrowing from the payday loan lenders for getting debt free. If you're a student, apply for scholarships so as to minimize the chances of taking out an educational loan.

How to be debt free: 8 Tips which you need to pay attention to

Life is better when you have no dues to pay off. These tips can help you get rid of your debts.

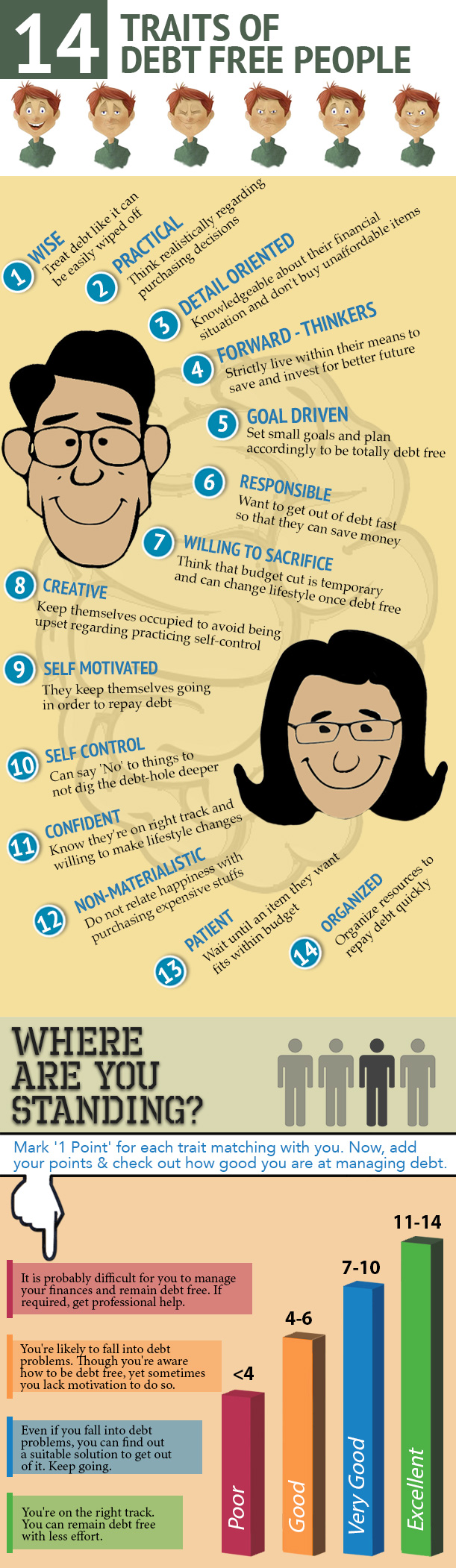

Habits of people who never worry about debt

These are the habits of people who prefer living with no debt. You can consider these as useful debt-free living tips and check out how many of these habits you follow.

1) Prioritizing on debt free living:

Every day, these people remind themselves that they have to be careful about not to let the money go down the wind.2) Creating a wide gap between earning and expenditure:

If you’re wondering how to repay dues, then the main thing is to create as much gap as possible between your income and expenditure.3) Valuing the time-money relationship:

You need to segregate between the chores that you can do on your own and which you need to outsource. People who don’t have debt know how to value time to improve financial life.4) Considering lower income than actual earning:

The best way to become debt free is to consider your income much less than what you earn. People, who want to stay away from debt, plan a realistic budget with 10%-50% less than what they earn. They save and invest the remaining amount for a better financial future.5) Not paying heed to peer pressure:

Always there will be some friends asking to spend on your non-priority things. But, you need to prioritize your expenses and not pay heed to what others are saying.6) Planning for the unforeseen circumstances:

People living with no debt have funds available for unexpected expenses. Doing so, they don’t fall into debt as they have the cash reserve to meet those expenses.7) Having the patience to save money for a big-ticket item:

Ultimately life is better if one can patiently wait and save for a big ticket item instead of using a credit card. It is difficult to wait for long when you can easily swipe your cards, but it’s beneficial in the long run if you save the amount and then purchase the item.8) Visualizing the financial situation 5-10 years ahead:

Wise people make the choices today in alignment with long-term success to benefit in the future. This helps to overcome the hurdles of the present.9) Not relying on one income:

People, who don’t encourage borrowing money, prefer multiple sources of income instead of relying on only one. They want to value their leisure time to build a secure financial future.10) Scheduling money meetings:

Periodical money meetings help you analyze your financial situation and decide necessary steps you need to take. People who want to stay away from debt usually arrange a weekly financial meeting with their partner.

The invisible price you have to pay for a debt-free lifestyle

Words are not enough to describe your feelings when you lead a debt-free lifestyle after years of being burdened with debt problems. Suddenly, you have lots of choices and the freedom to make decisions, which didn’t exist before. But reaching to that place of freedom is difficult. You have to pay a price. You have to sacrifice luxuries, work hard, say ‘no’ to expensive vacations, lavish parties, branded clothes, and so on.

Once you get out of debt and enjoy the first taste of freedom, there are new costs you have to endure. Here are a few of them.

1 You have to still practice the art of saying ‘no’

If you want to lead a debt-free life, then live within your means. This implies you still can’t say ‘yes’ to impulsive purchases, reckless whipping of credit cards and extravagant lifestyle. You may miss out many opportunities to enjoy luxuries of life. You may feel bad sometimes and wish you could take advantage of all the opportunities.

Whenever you feel low, think about the days when you were in debt. Think about how you got debt free. Think about the sleepless nights, stress, tension and worries that were your constant companion. You’ll feel better.

2 You may be ‘termed’ as weird by others

You’ll meet many people who would call you weird and encourage you to stay away from a debt-free lifestyle. Our society does not support your choice to lead a debt-free lifestyle. Your friends, relatives, neighbors, will tell that you’re weird and you may feel uncomfortable. Some would even criticize your decision.

Don’t get manipulated by what people say to you. Be firm and resolute. Explain why you have made the decision in a positive way. Perhaps, everyone will be convinced and may start living frugally.

3 No more expensive vacations

When you were less financially responsible, you had expensive vacations, bought items you couldn’t afford, whipped credit cards for your ‘wants’. But the scenario has changed now. You lead a debt free lifestyle now where there is no place for impulsive purchases and impulsive decisions.

Ways to become debt free - 3 Popular ways

As we have mentioned before about choosing an appropriate debt relief strategy, here is a brief overview of them for you to decide.

If you want to obtain low-interest rates and reduce your debt burden, you can opt for debt consolidation. Doing so, you can consolidate high-interest bills into one affordable payment every month.

There are 3 different ways to consolidate credit card bills along with other debts into a single monthly payment. An overview of each of the ways is given below.

-

Balance transfer

This option is specifically meant for those who'd like to consolidate credit card debt on their own. If one of your credit cards has a large credit limit and low-interest rate, then you can transfer your balances into this credit card. This will help in reducing your debt burden to some extent. However, prior to taking this approach, you need to read through the terms and conditions of the balance transfer.

If you take out a balance transfer card at a low-interest rate (often at 0% rate) and transfer all your balances into the new card, you'll be charged a balance transfer fee. This fee is around 2-4% of the transferred balance. The 0% rate offer usually lasts for 6 months to 1 year. The 0% rate cards often come along with certain rules; for example, you may not be able to use the card for a purchase. Doing so, the 0% rate offer may become void and/or you may have to pay a high rate of interest on the card balance.

Advantages of this debt consolidation method:

- The method is useful when you have multiple credit card debts.

- All your other credit card debts get wiped out at one go.

- Your new card should have lower interest rates. The bank may also willingly charge less, ideally 0% for a certain period; so you save a lot of money as interest payment.

- You now will be having only one credit card to deal with.

-

Debt/Bill consolidation program

When you're not comfortable going for a balance transfer on your credit cards, you may seek professional help in consolidating your debts. You can go for an online consolidation service to consolidate your bills. Such services offer best bill consolidation programs which make it easier for you to pay off debt.

When you enroll in a bill consolidation program, a debt consultant reviews your financial situation and works with your creditors to bring down the interest rates on your accounts. This is to ensure that you don't have problems in making your debt payments. The best thing about a consolidation program is that it relieves you from the stress of managing several payments at a time.

Advantages of this debt consolidation method:

- This method of consolidation helps you maintain a good budgeting strategy.

- You will be regular at maintaining payments, which will help you achieve a good credit score. The debts will also be updated as 'Paid in Full' in your credit reports.

- You pay consistently to your creditors without thinking much about your debts.

- No more harassing calls from creditors.

-

Consolidation loan

With the help of a consolidation loan, you can consolidate your bills into one monthly payment. There are primarily 2 types of consolidation loan you can take out:

1. Personal debt consolidation loan

This is an option using which you can repay multiple bills (credit cards, payday loans, student loans, etc.) with a single lump sum payment. You can also opt for utility bill consolidation by taking out such a consolidation loan. A personal debt consolidation loan requires low monthly payments in comparison to what you pay on your bills.

2. Secured debt consolidation loan

These are home equity loans or lines of credit which you can take out keeping your primary or vacation home as the collateral. Such a loan can help you repay your debts with a large amount. But you need to have a good credit history and income potential to qualify for an equity loan or line of credit. Make sure you control your spending and save enough to make your loan payments on time. Otherwise, if you default on the equity loan, you may risk losing your home in a foreclosure.

Advantages of this debt consolidation method:

- You need to manage only one loan and therefore, a single monthly payment.

- If you can maintain your payments accordingly, you will hit a good credit score over time.

- Since you have only one amount to pay and that too at a relatively low interest rate, you will save more dollars than you could have previously.

- You can repay your debts on your own by taking out a suitable loan.

Whichever way you choose to consolidate your debts, you need to avoid using the accounts which you're trying to get rid of. This will prevent you from adding on to your debt balance. Especially, if you have credit card debts, it is better not to punch the cards when you've planned to pay off the debt. Just make the required monthly payments and repay the debt within a definite time.

If you want to become debt free fast by paying less than what you owe, you can opt for debt settlement.

There are 2 different ways to settle your bills into a single monthly payment. An overview of each of the ways is given below.

Debt/Bill settlement program

When you want complete professional help to settle your debts, you can enroll in a settlement program. You can simply call a reliable settlement company or a law firm to enroll in such a program.

When you do so, a debt consultant or a lawyer reviews your financial situation and negotiates with your creditors to reduce your payoff amounts. You just have to make an agreed-upon affordable payment to the settlement company every month, which will be deposited into an escrow account in your name. Every other thing will be handled by the settlement company or the law firm.

The best thing about this is that it relieves you from the stress of managing several payments at a time.

Advantages of this debt settlement method:

- This method of settlement helps you maintain a good budgeting strategy since you just have to make a payment to the settlement company.

- You won't have to negotiate or worry about making payments to the creditors; the settlement company makes lump sum payments to your creditors once a sufficient amount gets accumulated in your escrow account.

- No more harassing calls from creditors.

DIY debt settlement

If you think you can convince your creditors on your own to reduce the payoff amounts, you can opt for DIY settlement.

You have to calculate how much you can pay for each account, and based on that you can negotiate with your creditors and/or collection agencies to reduce the amount you owe.

Advantages of this debt settlement method:

- You won't have to waste time choosing a good settlement company / law firm.

- You can explain your financial situation in a better way.

- You can save the professional fee that you can use to settle debts.

If you have tried other options but haven't succeeded, then you can file bankruptcy to give a fresh start to your financial situation.

You can file Chapter 7 or Chapter 13 bankruptcy based on your financial condition and what you qualify for.

Chapter 7 bankruptcy

If you qualify the eligibility criteria, you can get discharge from all or most of your debts by liquidating your non-exempt assets. Through this process, you get discharged from your debts/ bills legally. It is also known as Liquidation Bankruptcy.

Advantages of this bankruptcy method:

- You can become debt free within 3-4 months.

- You can get discharge from your debts without losing any asset.

- Once the process starts, creditors and collection agencies won't bother you anymore.

Chapter 13 bankruptcy

You can opt for this bankruptcy chapter if you want to repay debts within a period of 3-5 years. Through this debt relief strategy, you can keep your non-exempt assets and repay creditors with the help of a repayment plan. It is also known as Reorganization Bankruptcy.

Advantages of this bankruptcy method:

- You can get discharged from your debts and also keep your non-exempt assets.

- You can include debts that can't be discharged under Chapter 7.

- You can avoid wage garnishment.

It is not easy to live comfortably when you're living with debt. However, don't get too much stressed to get back on the right financial path. Relax and entertain yourself by reading a good book or watching a TV show. Your mind will work fast when you are properly rested.

Your job doesn’t end even after paying back debts as you need to learn how to stay debt free throughout your life and secure your financial future. Check out how to manage finances after being debt free.