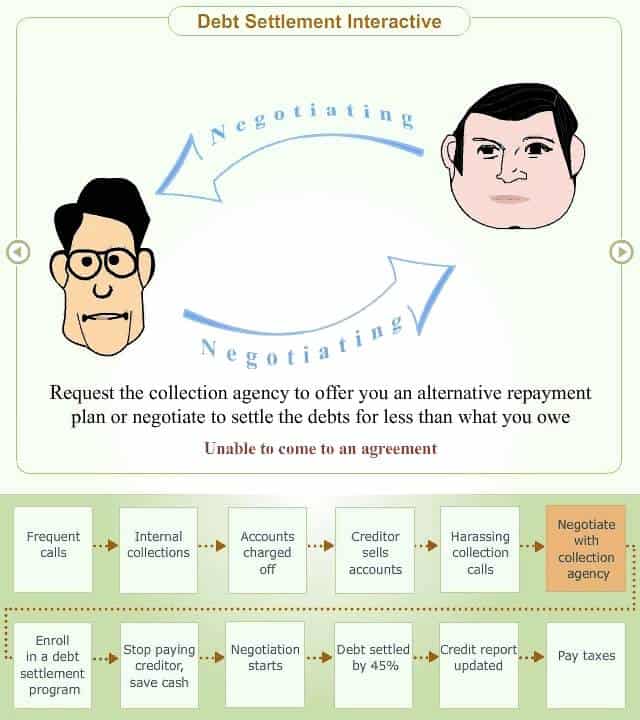

Watch interactive video and get a step-by-step guide to negotiate debt

- Due to non-payment, creditor hands over the accounts to their Internal Collections Department

- Creditor closes the accounts and sells them off to a third-party CA

- The collection agency (CA) calls frequently to collect on the debts

- You go for a counseling session with a law firm and enroll in their program

- Stop paying to the creditor and accumulate cash for one-time settlement

- The law firm negotiates for a lower payoff amount with the CA

- After they reach an agreement, the firm pays the accumulated amount and the debt is settled for a much lower amount

- The account status gets updated as “Paid as settled”

- The IRS may charge a tax on the forgiven debt amount

- What is debt negotiation all about?

- What debts can be negotiated?

- When should you go for negotiation?

- What happens in debt negotiation?

- How do you benefit from negotiation?

- What if your account is charged-off?

- How much do you pay for negotiation?

- Does debt negotiation affect your credit?

- How does settlement influences your credit score?

- What factors affect your credit score after settlement?

- How can you negotiate and restore your credit?

- What are the tax consequences?

If you're unable to manage your debts simply by cutting your expenses or you don't find it favorable to consolidate your bills and reduce the interest rates, you may go for a debt negotiation services. Whether you have mounting credit card bills, payday loans or medical bills, debt negotiation services can help reduce your outstanding balance so that you find it easier to repay and get out of debt.

What is debt negotiation all about?

Debt negotiation or debt settlement is all about negotiating with your creditors or collection agencies (CAs) in order to reduce your outstanding debt balance. The purpose is to make your creditors accept a lower payment amount.

What debts can be negotiated?

- Unsecured credit cards

- Medical bills

- Payday loans

- Personal loans

- Store cards

- Bounced checks

Student loans can be negotiated if they are not insured by the Federal Government.

When should you go for negotiation?

Negotiation may not be a debt solution for all. It depends upon the individual situation and the amount he owes.

- You cannot make payments for past 3 months

- You're in hardship such as job loss or medical emergency

- Creditors are threatening to file a lawsuit

- The account is sold off to collection agency and they're harassing you

- You cannot make use of debt consolidation program

- Bankruptcy seems to you as the only debt relief option

What happens in debt negotiation?

Negotiation is offered by settlement companies which communicate with creditors and debt collectors in order to reduce your outstanding balance. Creditors agree to negotiate depending upon the status of your delinquent accounts, your total debt amount and the age of the debt accounts. Here are the 6 steps in a debt negotiation program.

Debt counseling

A debt negotiation or settlement company will offer you a free counseling session. Herein a counselor will review your situation to find out if a debt negotiation program is suitable for you.

Realistic budget

The company will help prepare a realistic budget for you in order to free up cash flow so that you can pay off your bills after negotiation. The budget gives a clear idea of what you can pay and how much the company needs to negotiate creditors on your behalf.

Calculate program term

The company will review your income and set the program term for 2-4 years depending upon how much funds you can accumulate for debt payoff.

Trust account

The company will create a trust account (bank account) for you. Instead of paying creditors, you'll have to deposit a monthly payment into the trust account. This continues till the funds accumulated are enough to start the negotiation.

The trust account does not earn interest. But it is insured by the FDIC (Federal Deposit Insurance Corporation) for an amount up to $100,000. You will receive monthly statements of all transactions on your trust account and the funds available for negotiation.

Negotiation with creditors/CAs

Negotiation starts off when you've saved about 50% of your outstanding balance into the trust account. The amount negotiated depends upon the creditor/CA and the money you owe.

Settlement offer

The negotiation companies will not settle the debt without your approval. Once the creditors (or CA) accept a reduced settlement offer, the company will request them to send you the offer in writing. Based on the offer, you'll make a lump sum payment to your creditors from the funds in your trust account. Your debt is thus settled at an amount lower than what you owe.

How do you benefit from negotiation?

Debt negotiation offers you the following benefits.

What if your account is charged-off?

Debt negotiation fees depend upon the number of credit accounts you have, the amount you owe and the money you can save through negotiation. Some companies may charge 25%-35% of what you save.

How much do you pay for negotiation?

If one of your accounts is charged off or sent to collections, your account status will be reported as a "Charge-off" which has a negative impact on your credit score. Your creditor may continue to list its trade-line on your report for 7 years. However, you can request the CA (collection agency) to change the account status as "Paid charge off" or "Paid in full" when you pay the charge-off in full. However, if you settle the charged-off debt, your account status will be updated as "Settled charge-off". This will help to reduce the negative impact of a charge-off on your credit report.

Does debt negotiation affect your credit?

Creditors don't agree to negotiate debt until and unless you're behind for 3 months or more. Moreover, negotiation requires you to stop paying creditors till you have gathered enough funds to settle your bills. Since you don't make payments for a number of months, your credit report shows the account as "delinquent". Your account may also be charged-off by the creditor or collection agency. Such things ruin your credit and bring down your score. However, once you settle the bills, your credit score will improve gradually with time.

How does settlement influences your credit score?

When you settle debts, it leaves a negative scar on your credit report. That's because you may have missed payments prior to negotiating a debt settlement. Or, when you've enrolled in a settlement program, the negotiator may have asked you to stop paying your creditors till you've gathered enough funds for settling your accounts. Missed payments or stop payments affect your credit in a negative way thereby bringing down your score by 50 points or so.

As you go on settling your dues one by one, you'll receive a letter from your creditors stating that the debts have been paid back. Your creditors are likely to report the account status to the credit bureaus. Some of them may report a settled account as "Paid as settled" or "Debt settled for less than the full amount due".

What factors affect your credit score after settlement?

There are 4 factors that affect your score after you settle your accounts. These are:

- Number of creditors reporting your account status as "Settled".

- Number of accounts (on your credit report) showing positive activity.

- Average age of your accounts.

- History of late/missed payments on the settled accounts and other bills.

How can you negotiate and restore your credit?

When you work with creditors regarding the payments for settlement, try to negotiate a pay for delete agreement. Under this agreement, your account listing will be deleted from your credit report after settlement.

However, if your account is charged off and sent to collections, you may request the original creditor to pull it back from the CA and remove the charge-off from your credit report. Before you contact the creditor, decide upon how much you can pay in order to settle the account. The more you can afford and the faster you pay, the greater are your chances of having the charge-off removed.

When the creditor agrees to remove the charge-off, request him to give it in writing. Avoid making any payment towards the account till you get the agreement signed by your creditor. Once you've paid in full or settled the account with your creditor, check if the charge-off has been removed from your credit report. Prior to working out a settlement, negotiate with the creditor to report your account as "Paid in full" or "Paid as agreed". This will help to restore your credit after settlement. However, if you keep paying others bills on time, your credit score will get even better.

What are the tax consequences?

When your bills are settled, the IRS considers the amount forgiven as taxable income. For example, if your forgiven debt is $4500 and you're in the 15% tax bracket, then you'll have to pay $675 as income tax. However, you will not be liable for such taxes if the creditor settles your debt because you protest an owed amount.

With debt negotiation, your credit gets tarnished and you may incur taxes on forgiven debt. However, negotiation reduces your liability towards debt and here lies its importance. The purpose of debt negotiation is to help you fulfill your obligation so that you can lead a debt free life.