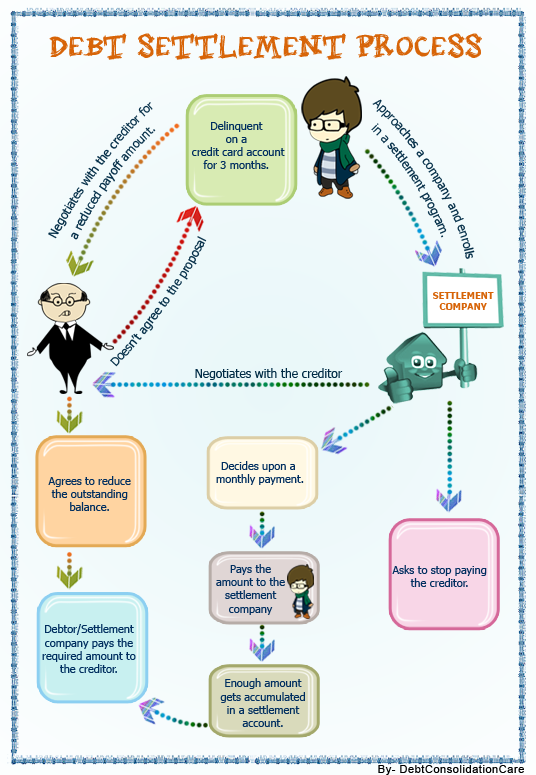

In the process of debt settlement a third party or you yourself negotiate with your creditors to reduce the debt amount. Debt Settlement agencies work with your creditors to reduce your debt balance, sometimes by as much as 30%-60%.

9 Easy Steps to Debt Settlement in a chronological manner

He will suggest you with a settlement program and if you agree you will need to fill up some basic forms.

All accounts for those cards in dispute are closed. You are requested to avoid using those credit cards while on the program.

The Debt Settlement Company then contacts these creditors and reconfirm that they should not be communicating with you.

Deposit the fund in a separate account while the settlement program is on, which will be used by the Debt Settlement Company.

All settlements are based on the amount and type of debt you owe and the amount of funds you have.

The monthly payment starts henceforth to eliminate the account at the revised amount.

A client with average debt can complete a debt settlement program in 36 months or even less.

Debt Settlement Company do not make bulk settlements like many other companies and so are able to get better results by giving you individual attention.

Your account is expected to have a decent status now.