How women are better money managers and tips of managing money

“Women in Leadership: Achieving an equal future in a COVID-19 world” - This is the global UN theme for International Women’s Day in 2021. This theme has been coined to celebrate the exceptional efforts of women, all around the world, for an equal future. Modern-day women have been able to solve their problems and build a better future for themselves and their families.

When talking about achieving equality in every sphere, the financial sector is an important part of it.

16 Hidden traits that make women better money managers

"Some studies show that women can be better money managers than men because they tend to be more conservative and do their homework. Men tend to take more risks without the research."

Let’s not support this fact just because it’s Women’s Day :-) Let’s have statistical data to prove the point!

A study, conducted by Vanguard on 2.7 million IRS investors in 2009, revealed that during the economic crisis (2008-2009), the accounts led by women lost about 13% whereas the accounts led by men lost about 16%.

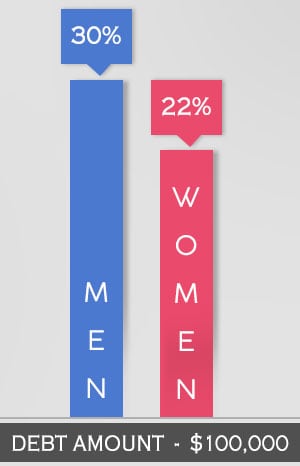

Women are also less likely to incur large amounts of debt as compared to their counterparts. The study also revealed that about 30% of men had $100,000 of debt whereas only about 22% of women had the same debt amount.

Another interesting thing was pointed out by a research conducted by the American Journal of Psychiatry in 2006. Women are usually regarded as impulsive buyers, and the study showed that 6% of women were like that, but about 5.5% of men belonged to that group. So, men are not far behind.

Let’s discuss 16 personality traits that make women better money managers:

1 Women are confident, but not overconfident

There is a thin line of difference between being confident and being overconfident, and women know the difference. Overconfidence often leads to holding a stock for too long, whereas sometimes, selling it before, maybe more profitable.

2 Perfectionist - Another good trait of a woman

To be a perfectionist, you have to be detail-oriented. It is said that crossing your T’s and dotting your I’s play a significant role when it is all about managing a business. If you’re an entrepreneur, having perfect detail-oriented eyes can help you climb the pillars of success easily.

3 Women love to set their trend to manage finances

Instead of following the herd, women want to set their trends. They want to research and plan their investment strategies.

4 Women research before making a decision

One of the best qualities in most women is that they want to research their options before making a decision. Usually, women want to gather information from various sources, take time to go through the pros and cons, and then initiate a plan of action.

5 ‘Competition’ is comparatively a man’s trait

It is true that competitive spirit is good, but when money management is the issue, it’s better to be less competitive.

6 Self-control - Women can do it better

Who are better money managers - Men or women? Studies have pointed to the fact that women have more self-controlling power. Therefore, they can hold on to a good investment, and resist the temptation to sell it. As a result, they avoid frequent trading which doesn't add much value to the investments.

7 Women like to take risks, but not much

Due to less overconfidence, women tend to be a bit pessimistic about making risky decisions, so they experience loss comparatively less.

8 Collaboration - A trait more common in women

A woman binds the family together. She collaborates with others to make things happen to achieve financial goals. She treats money management as a team affair - collects information from others (family members, friends, colleagues, etc.) and makes suitable financial decisions.

9 A woman usually admits her mistakes

When you admit your mistake and are ready to rectify it, you can minimize the loss. So, a woman can sell her investment if she knows that she wouldn't get a profitable return.

10 Better students - Men or women?

Everyone knows that women are better students and there’s no exception when it is about managing finance. You need to do research and make thoughtful decisions to manage finances in a better way, and women are good at that.

11 Men are more open to debt, but women are hesitant

Who are better money managers - Men or women? When it is about debt, women win. Most men think that debt opens up new opportunities, which is somewhat true. However, incurring too much debt can be sometimes disastrous for your finances.

12 A woman doesn’t like breaking rules

Several surveys point to the fact that comparatively women are less likely to get arrested for drunk driving (About 4% less likely than men) and breaking traffic rules. They usually like to follow the rules. So, they like to follow better money management rules,too.

13 Women don’t hesitate to ask for help

A woman usually never hesitates to ask for help. As per a report published by Fidelity, women are more willing to take help from financial experts on how to manage personal finance. This nature of being smart and humble at the same time, helps a woman to come out of difficult financial situations.

14 A woman’s tool is ‘Fear’ instead of ‘Anger’

When there is uncertainty about the performance of an investment, women usually try to respond with fear instead of getting angry. So, a woman assesses danger and tries to minimize the damage.

15 Patience - Undoubtedly, women are better at this

A person has to be very patient when it is the matter of paying off debt. Usually, men like to play more energetic games than women. Wait wait! I know, of course, exceptions are there. To repay debt, you need to plan a suitable budget and a repayment plan and be patient to wipe out debt one by one. And, women are good at this!

16 Having peace of mind is the ultimate goal

Usually, for a woman, peace of mind is the ultimate goal instead of having a goal of wealth accumulation. Their ultimate goal is to have a secure and sound financial future for her family. So, they want to have risk-free investments that will have ensured returns in the future.

Finally, in this regard, it can be said that though FINANCE is regarded as a male-dominated realm, yet comparatively women are becoming better at managing money to some extent.

However, are you one of those women who are going through financial problems and don't have a clue how to get out of it? Well, if that is the case, then there is no need to get panic-stricken.

How women can be better at managing finances and solving financial problems

Here are some interesting ways to solve your financial problems and manage finances in a better way.

Gather proper financial knowledge

For each and everything proper education is important and managing personal finance is not an exception. You can take up an investing class in a community center to learn the ins and outs of investment.

It will help you make an investment portfolio or play an active role in deciding the investment plan for a secured financial future for your family.

Take initiative in family finance

Even if your spouse manages the money, you should take an active role in it. You can call a family meeting and decide the budget plan as well as investment strategies, and also involve your children so that they learn it from a young age. When your children become teenagers, they should understand their family's financial situation and how they can contribute to making it better.

You take initiative to check whether or not the bills are paid on time, whether or not you can reduce the insurance premium payments, and so on.

Make use of financial tools

Several online financial tools are available which you can use for better financial management. For example, there are budget tools that you can use free of cost; you can make a plan and review from time to time to plan a realistic budget that you can follow.

If you’re facing a debt problem and looking for a way out, you can take the help of debt calculators to check how long it’ll take to get out of debt.

Have an emergency fund

Every household should have an emergency fund to take care of the rainy days. So, contribute at least 10% of the family's monthly income to have a significant amount. Try to have a fund worth of meeting 5-6 months of your necessities. Do not use the money unless it's a real emergency.

As a woman, you play the role of motivating your family members to follow the budget and save every month for a better and a secured financial future.

Along with the above, also follow these things to manage finances in a better way.

List and track your expenses, and plan a budget

List all your expenses in a Microsoft Excel spreadsheet. The list should include your living expenses, debt expenses, etc. Calculate the amount you have to spend each month on your household, mortgage, insurance, etc. This will help you realize your overall debt expenses in a month.

As mentioned earlier in this article, it is essential to make a proper financial plan and a budget to deal with your finances properly.

Reduce your debt-to-income ratio

Calculate your debt-to-income ratio per month. This will help you know the percentage of your gross monthly income that gets exhausted on your debt expenses. You will aim to reduce this ratio. A proper budget will help you do that. Allocate money for all your necessary expenses. Find out the categories where you can avoid spending money. You may use online budget planners available nowadays.

If your debt is out of control, you can take professional help to repay debt. After paying back debts, you’ll have extra money, at the end of the month, to invest for a better financial future.

Restructure spending habits to save more

Several women get into financial problems due to their shopaholic nature. Most women love to indulge in impulse shopping. If you are one of them, then it's time to stop that. You should spend your dollars on household and debt expenses. If you do have some spare cash in your hand at the end of the month, either save it for emergency expenses or use it to pay back your creditors.

However, keep a portion in your budget to meet your wants but remember not to splurge much.

Earn extra dollars to improve the financial situation

Are you a good cook or have a special talent for knitting? If yes, then it's time to utilize these skills for earning extra dollars. You can bake cookies and sell them in your neighborhood. You may even knit beautiful cardigans and sell them. You can also give tuitions after returning from your office and earn extra cash.

However, don't forget to utilize this extra cash towards paying back debts and become debt-free asap.

Try to save a substantial amount every month

Most women lack this expertise. Your motto should be to save as much as you possibly can. It is possible. Try to save on your electricity bills, water bills, transport bills, etc. The saved money will help you get out of financial problems early.

Finally, try to use cash for making purchases as credit cards come with high-interest rates. You can also set up an automatic bill payment system. This will help you make payments to your creditors within due dates.

One major part of financial management is to cut back expenses and save dollars.

How you can cut expenses and still enjoy life!

Having fun is not such a bad thing, but the fun part must be balanced with sound financials.

Do not think that you will have to compromise with your enjoyment to save more. You can cut back expenses and enjoy at the same time. Let’s see how!

Shop until you drop, but make smart choices

Who says you need to cut down on your shopping if you want to live on a budget? But what you must do is make smart shopping decisions. Wait till that time of the year when you get some crazy discounts on new clothes and other branded goods. If you know when your favorite store offers huge discounts on apparel at the end of a season, make sure you wait for this sale. Set aside a sum for this shopping expedition and make sure you don’t spend it on other things.

Save money while dining out

Going out with your friends? Worried about spending more than you can afford? Don’t worry. You can access a variety of gift certificates offered by some of the best restaurants in town. Ask your friends to pool in money for a certificate of choice, so you can all enjoy dining out on the cheap. Worried about paying a premium on the drinks (It’s a girls night out remember!)? Make a list of restaurants that you want to go to, and call them up. Ask them, if you can Bring Your Own Booze. You will be surprised to hear plenty of restaurants answering with a ‘yes’ to your question!

Several restaurants offer discounts on particular days in a week. Get more information on such restaurants and plan your girls’ night out around the days these restaurants offer discounts.

Swap with friends

If you’ve got a big friends circle, why not swap your clothes and accessories with them! Many of them will have clothes, shoes, glasses, belts, purses, etc. that they might not be using. And what’s even more important, they might want something that you have but aren’t using. This is a win-win situation for everybody; you can swap items, save money, and wear the clothes and accessories you want.

Stop going to the gym

No, this doesn’t mean you should stop exercising; it’s just that you can stop exercising at the gym and start exercising in your home. You can also exercise in the fresh year in your backyard or at a nearby park. On weekends, you can go for a hike with your family and enjoy the quality time together.

Typical gym membership costs an average of about $134 per month, which is more than $1600 per year. It’s quite a big amount. You can use this money on some other things or just invest in a high-performance fund.

Don’t worry; you won’t miss the gym workout if you perform the same workouts at home. There are plenty of workout videos available on the internet. Just follow them. You could even go to your neighborhood park for an early morning workout session or exercise in your garden. So, there is no reason why you shouldn’t stop going to the gym if you want to save money.

Save on entertainment

Don’t panic! Saving on your entertainment costs doesn’t mean cutting down your visit to the movie theatre; all it means is looking for money-saving options. So, if you are a movie buff, and frequently visit a particular chain of theaters, why not look for some loyalty card that offers a loyalty bonus. You could also look at cheaper movie tickets at stores like Costco. Or how about cutting down on your theatre visits by joining the neighborhood library? A yearly membership gives you access to a well-stocked DVD library and you could also pick a few books that you would like to read.

Manage your daily household expenses

Women are quite smart when it comes to managing a household on a budget and leading a frugal life. You may have lots of responsibilities on your shoulders but if you can manage to have a budget, you can save money fast and well.

Take a look at the various ways you can save on your household expenses.

You must always learn to wait to arrange money before purchasing something and not overspend. You can also save more if you can wait for a certain time and gradually grow your money tree.

Have you ever realized how often you keep your thermostat on 70 degrees throughout the year, which is useless? You'll be surprised when to save about $20 per month on utility bills by simply balancing the temperature according to the weather and season.

This is true and many have benefited from it. If you have different boxes for different purposes and can save money on them, you can manage to have a good savings plan.

Create a savings account in your nearby bank and don't try to take any money out of it. If you do it, you'll never be able to save.

Create different piggy banks to keep small amounts of money so that you can pay for your emergencies, debts, medicines, and other things.

A lot of items and things can be made at home without much effort. You can make solutions to clean stains and other dirt from carpets and make your furniture squeaky clean. Make use of lemons, lime juice, baking powder, etc. to make cleaning agents at home.

Also, look for easy recipes on the internet and cook food at home so that you can save money. You can go to the restaurants once every month and you won't feel the pinch too.

This can help you manage your household expenses in a better way. Try to open a small business at home and do things that you're good at. You can start a daycare center at home or you can also teach kids the subjects you know well. This can be a good income. Once you start earning well, you can make it big and flourish anytime. Nowadays, you can give online tuitions, too.

Try to be happy with what you have and pass your happiness to other members of your family. The less you spend, the less money you owe, and this way you can lead to a tension-free and joyous life. If you have no financial stress, you can be happy in your life; in turn, you can have a good life and can save a lot too. You can also teach your kids about the money-saving qualities and the ways they can be implemented.

- Keep patience

- Adjust your thermostat

- Explore different boxes for savings

- Follow DIY mantra

- Become an entrepreneur at home

- Be happy with your lifestyle

Pamper yourself on a budget!

The depressing thing about a credit crunch is that even beauty comes at a price, and in this current climate, we can barely afford it! You might be relieved to hear that you can still pamper yourself without the huge price tag.

All you need is a kettle, a towel, and a heatproof bowl. Make sure you've cleaned off all your makeup, and then fill your bowl with boiling water. Add a few drops of essential oil if available at home; or else, put a few drops of lemon juice. Sit down and hang your face over the bowl - don't forget to cover with a towel to keep all the steam in. Afterward, your skin will feel immaculate and you will feel relaxed.

If you've got kids, you've probably forgotten the last time you managed to get the bath to yourself. Run yourself a warm one and add a couple of cups of milk. If you have any herbs or rose petals, throw some of those in too. The important thing is that you need to relax. Although the milk in the water will nourish your skin, de-stressing is the fastest way to feel beautiful. Light a few candles for ambiance and pour yourself a generous glass of wine. Enjoy a good time.

Although you could petition for the remote control and watch your favorite movies, you may find it easier to enjoy a great book. There's nothing like getting lost in a fantasy world and it's a lovely way to wind down before you get an early night. The television can stop you from getting the beauty sleep you need by stimulating your brain.

Do not feel guilty about pampering yourself, getting your favorite box of chocolates, or buying that gorgeous dress you've been lusting over for ages. This is a once-in-a-blue-moon occurrence, so be determined to enjoy it in style. However, plan it properly so that it doesn't hamper your financial situation much.

If you have a partner or cajole, flatter or blackmail them into giving you a massage. You won't believe how relaxed you will feel. Invest in some scented massage oils to spice it up a bit.

Choose a lovely shade of nail varnish, put on some music, and trim your nails. Meanwhile, soak your feet in a bowl of soapy, warm water. Keep some cotton buds and varnish remover for those little slip-ups, but enjoy painting your nails in peace. As you wait for your nails to dry, watch one of your favorite episodes on television.

So, as you can see, you don’t have to spend a lot to enjoy!

Do you have any other points to support the thought that women are better financial managers or how women can manage finances in a better way? Feel free to give your opinion even if it’s against it!

- Do a home facial

- Take a good bath

- Read a good book

- Enjoy a guilt-free night

- Have a good massage at home

- Give yourself a manicure and pedicure