How to Pay Off $30K Student Loans Fast and Save Thousands

Key Takeaways

- $1.777 trillion in student debt in the US and the average federal borrower owes $38,375

- $30K balance takes 10 years to pay off under standard repayment

- 64% of borrowers say student loans negatively impact their mental health

- You’re not alone and there’s a way out

If you look at a $30,000 student loan balance you feel overwhelmed. You’re not alone. Millions of Americans wake up every day with student debt. The Education Trust says 64% of borrowers say student loans hurt their mental health. This affects career decisions and relationships.

But the truth is your debt doesn’t define your future. You can pay off that $30,000 balance years ahead of schedule. You can get your financial freedom and peace of mind back.

In this article you’ll get a full roadmap for $30,000 in debt. You’ll learn strategies that work for thousands of borrowers. These methods speed up payoff timelines. They reduce interest costs. They build lasting financial habits. You can start changing your path today.

How Much Your $30K Loan Really Costs You

Most borrowers don't know their true debt cost. They see the balance but miss the bigger picture. Understanding exactly what you owe and what it really costs helps you make smart payoff decisions.

Find All Your Hidden Student Loans

You need to know exactly what you fight before you can defeat your debt. Create a list of each loan:

- Balance: How much you owe now

- Interest rate: Your annual percentage rate (APR)

- Term: How long do you have to pay

- Servicer: The company that handles your payments

- Grace period: Time before payments start (for new graduates)

- Type: Federal or private loan

Log in to your loan servicer's website to gather this info. Don't skip this step. Many borrowers discover forgotten loans. Interest rates often vary between loans.

How Much Extra You'll Pay in Interest

Understanding the real cost motivates you. Here's what $30,000 in student loans actually costs:

| Repayment Strategy | Monthly Payment | Total Interest | Total Amount Paid | Time to Freedom |

|---|---|---|---|---|

| Standard 10-year | $337 | $10,439 | 40,439 | 0 years |

| Accelerated 5-year | $593 | $5,580 | $35,580 | 5 years |

| Your Savings | +$256/month | Save $4,859 | Save $4,859 | 5 years earlier |

[Based on a 6.39% interest rate (current undergraduate rate)]

Use our student loan payoff calculator below to see your personalized savings with different payment amounts and timelines.

This comparison shows how an extra $256 per month saves you nearly $5,000. You also get freedom five years earlier. Use online calculators with your specific loan details.

Free Up $400+ Monthly for Loan Payments

Finding extra money for loans doesn't require extreme sacrifice. Small changes to your spending and budget structure can free up hundreds of dollars monthly. This section shows you exactly where to find that money.

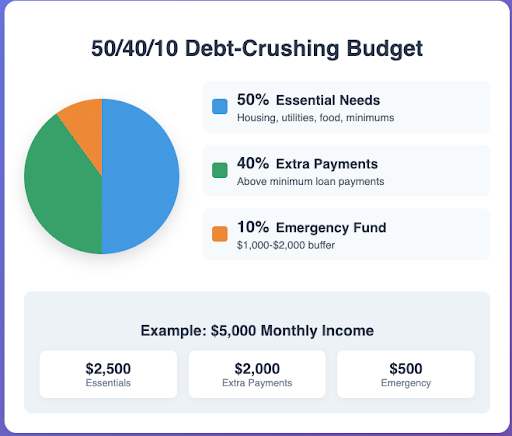

(Visual breakdown of the 50/40/10 budget pie chart showing how to allocate income during debt payoff)

Traditional budgeting suggests 50% needs, 30% wants and 20% savings. When you enter debt-payoff mode, flip this:

- 50% - Essential needs: Housing, utilities, food, transportation, minimum debt payments

- 40% - Debt elimination: Extra payments above minimums

- 10% - Emergency buffer: Small emergency fund ($1,000-$2,000)

This approach speeds up your timeline. You still maintain financial stability.

Where to Find Extra Money You Didn't Know You Had

Most people can find an extra $200-$400 monthly without major lifestyle changes:

Subscription purge checklist:

- Cancel streaming services you rarely use

- Drop gym memberships (try free alternatives)

- Eliminate software subscriptions and apps

- Stop magazine and newspaper subscriptions

Housing, insurance and food optimization:

- Shop insurance rates annually (you could save $100+/month)

- Plan meals and prep groceries (save $150+/month)

- Consider house hacking or roommate arrangements

- Negotiate phone and internet bills

Simple Tricks to Stay Motivated During Payoff

Create a visual representation of your progress. Print a debt thermometer or progress bar and color in your achievements monthly. This psychological trick maintains motivation during the long payoff journey. Place it somewhere you see daily—your bathroom mirror, desk or refrigerator.

Which Payoff Method Saves You the Most Money?

Different strategies work for different people. Some prefer math-based approaches while others need psychological wins.

Choose the method that matches your personality and financial situation.

Debt Avalanche: Pay Less Interest (Best for Math People)

The avalanche method prioritizes loans with the highest interest rates first, minimizing the total interest you pay.

Example with $30K across two loans:

- Loan A: $20,000 at 6.5% interest

- Loan B: $10,000 at 4.5% interest

Pay minimums on both but direct all extra payments to Loan A first. Once you eliminate it, roll that entire payment to Loan B. This approach saves you the most money mathematically.

Debt Snowball: Stay Motivated with Quick Wins

The snowball method targets the smallest balance first, regardless of interest rate. Behavioral scientists have found this approach maintains motivation better because you experience wins faster.

Using the same example, you'd attack the $10,000 loan first, then the $20,000 loan. While you'll pay slightly more in interest, the psychological boost often leads to better long-term adherence.

The Hybrid Strategy: Get the Best of Both Worlds

Can't decide? Try this decision matrix:

- If your interest rates vary by less than 2%, use the snowball method

- If you see a significant rate difference (3%+), use the avalanche

- If you struggle with motivation, start with a snowball for the first victory, then switch to an avalanche

Cut 3+ Years Off Your Repayment with These Hacks

Simple payment tricks can dramatically reduce your payoff time. These strategies don't require extra income or major lifestyle changes. They just work smarter with the money you already have.

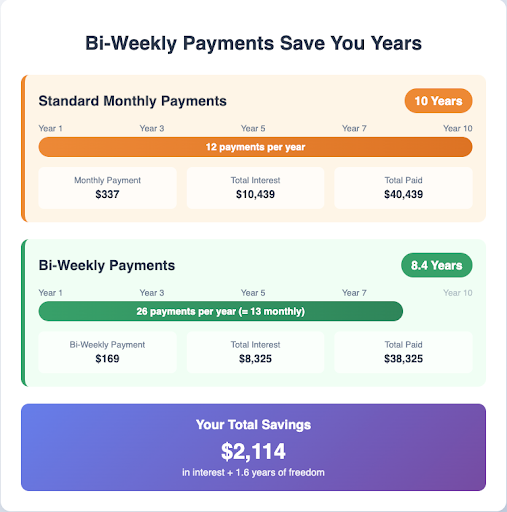

The Bi-Weekly Payment Trick That Saves $2,000+ in Interest

Instead of 12 monthly payments, make 26 bi-weekly payments. Pay every two weeks. This creates 13 monthly payments per year. It shaves years off your timeline.

Impact on $30K at 6.39% (current rate):

- Standard: 10 years, $10,439 interest

- Bi-weekly: 8.4 years, $8,325 interest

- You save: $2,114 and 1.6 years

What to Do with Tax Refunds and Bonuses

Direct 100% of unexpected money to loans:

- Tax refunds (average $2,800)

- Work bonuses

- Cash gifts

- Side hustle income

- Expense reimbursements

A single $3,000 windfall you apply to principal can save you $1,000+ in interest over the loan's life.

Apps That Pay Down Your Loans Automatically

Set up automatic extra payments, even if small. Apps like Qapital or Acorns round up purchases and can direct the spare change to debt payments. While amounts seem small, consistency compounds—$50 monthly in round-ups equals $600 annually in extra payments you make.

Make Extra Money to Eliminate Debt Faster

Earning additional income gives you the biggest impact on payoff speed. Even an extra $200-500 monthly can cut years off your timeline. Focus on opportunities that match your skills and schedule.

Side Hustles That Actually Pay Well

Focus on skills you already have:

Skill-based opportunities:

- Freelance writing or design

- Online tutoring

- Virtual assistant work

- Web development or programming

Service-based opportunities:

- Pet sitting through platforms like Rover

- Food delivery driving during peak hours

- House cleaning services

- Event assistance and support services

Income varies widely based on location, experience and time invested. Research current rates in your area.

Target is earning an extra $500-$1,000 monthly. Apply this income boost to debt. You can cut your payoff timeline in half.

How to Get Your Boss to Pay Your Student Loans

According to recent data 14% of employers now offer student loan repayment assistance up from 8% in 2019. Thanks to the Consolidated Appropriations Act employers can provide up to $5,250 annually in tax-free student loan assistance through December 31, 2025. This means both you and your employer save on taxes.

Check with HR about:

- Direct monthly payments towards your loans

- Lump sum annual contributions

- Matching programs (some employers match loan payments like 401(k) contributions)

- Combined education assistance programs

Even $100 monthly from your employer equals $1,200 annually in free debt reduction you receive. Some companies like Abbott Laboratories offer innovative programs where they will make retirement contributions if you pay down student loans, helping you pay down debt and save for the future at the same time.

Turn Your Hobbies into Loan Payments

Monetize your interests you already have:

- Sell handmade items on Etsy

- Offer photography services for events

- Create online courses about your expertise

- Flip items from thrift stores or garage sales

Earnings potential varies greatly based on market demand, skill level and time investment. These streams might generate $100-$300 monthly. Every dollar you earn speeds up your freedom date.

Government Programs That Can Erase Your Debt

Federal and state programs can really help with debt. These aren’t just for low-income borrowers. Many apply to middle-class earners with specific jobs or situations.

Get $2,500 Back on Your Taxes Each Year

Claim up to $2,500 annually in student loan interest as a tax deduction. This phase-out applies to higher incomes but can save borrowers hundreds of dollars in taxes. Keep track of the interest you pay throughout the year.

Public Service Loan Forgiveness and Current Policy Changes

Federal student loan policies are changing. The SAVE plan is being challenged in court. Some income-driven repayment plans are uncertain. Public Service Loan Forgiveness still works for qualifying borrowers.

If you work for a qualifying employer (government or eligible non-profit) PSLF forgives remaining federal loan balances after you make 120 qualifying payments.

Requirements:

- Work full-time for a qualifying employer

- Make payments under an income-driven repayment plan (currently IBR is the most stable)

- Submit annual employment certification forms

SAVE plan borrowers pursuing PSLF should consider switching to IBR or another stable IDR plan to continue making qualifying payments, as SAVE forbearance doesn’t count toward the 120-payment requirement.

For $30K in loans, this might be better than aggressive payoff if you work in public service early in your career with a lower income.

Should You Refinance or Stay Federal?

The student loan world changed a lot in 2025. The SAVE plan faces legal challenges. SAVE borrowers are in forbearance but interest started accruing in August 2025. Many borrowers switched to Income-Based Repayment (IBR) because it's more stable.

Income-driven repayment pros

You pay less each month because payments adjust to match what you actually earn. This flexibility becomes especially valuable if your income drops or you face financial hardships. The government will forgive any remaining debt after 20-25 years of qualifying payments. You also keep important federal protections that let you pause payments during emergencies. Right now, IBR offers your most reliable path to eventual forgiveness since other programs face legal challenges.

Refinancing pros

Private lenders often offer better rates than the current federal rates of 6.39% for undergrads and 7.94% for grads, especially if you have strong credit. This means you'll save money on interest and pay off your loans faster. You'll also get one simple monthly payment instead of juggling multiple federal loans with constantly changing rules. Perhaps most importantly, you avoid the uncertainty of federal policy shifts that keep affecting borrower programs.

Refinancing requirements

You need a credit score above 650 and steady income to qualify for the best rates. Your total monthly debt payments should stay under 50% of your income to meet most lenders' standards. The biggest trade-off is giving up federal protections permanently. Once you refinance with a private company, you can't return to federal programs if your situation changes.

Talk to a financial advisor before you make big changes. The rules keep shifting.

Protect Your Mental Health During Debt Payoff

Student debt is a significant source of stress and can impact your entire life. It not only affects your sleep and relationships but also badly impacts your daily decisions. Paying off loans is a long process— which is exactly why you need strategies to protect your mental health during the journey.

Steps to Consider When It Affects Your Mental Health

When student loan stress goes beyond your financial concerns. It impacts many areas of your life. But you can manage this stress in the following ways:

- You can meditate or practice mindfulness for 5-10 minutes daily

- Make a habit of exercise (even walking helps)

- Set a proper sleep time (aim for 7-9 hours when possible)

- Reduce your social media scrolling when you are feeling overwhelmed

- Accept and acknowledge small wins (like making an extra payment)

University of Georgia researchers analyzed over 85,000 social media posts about student loans and found high levels of depression and anxiety among borrowers. Another study found that high debt levels increase the risk of substance use issues and mental health symptoms. Taking care of your mental health is key during debt repayment.

Building Your Support Network

Don’t go through this alone. Share your goals with trusted friends or family members who will offer their support and encouragement.

Online communities such as Reddit’s r/StudentLoans and Facebook groups can be helpful too. You can connect with people who are mindful and share practical tips from those who have paid off their loans. Sometimes, you may find guidance from someone who has been in your shoes.

Change Your Perspective on Debt

Change your perspective towards viewing your debt as a permanent burden, think of it as a project with a deadline. Set your debt-free date and work backwards to create achievable milestones.

This might be paying off one loan completely or reaching a certain balance threshold. This mental reframe turns overwhelming debt into manageable steps with a finish line.

Your 90-Day Action Plan to Start Winning

Knowledge without action won't pay off your loans. This plan breaks down everything into manageable weekly tasks. Follow this timeline to build momentum and see real progress quickly.

Weeks 1-2: Get Organized and Set Your Foundation

- Complete the loan inventory and calculate the true costs you face

- Set up accounts with the loan servicers you use

- Create a debt focused budget using the 50/40/10 formula you implement it

- Choose your payoff strategy (avalanche, snowball or hybrid) that you prefer

Weeks 3-4: Optimize Your Budget and Payments

- Conduct a subscription and expense audit you need

- Set up automatic payments and a bi-weekly schedule you establish

- Research refinancing options if they apply to your situation

- Apply for employer student loan assistance if you qualify for

Weeks 5-8: Launch Your Income-Boosting Strategy

- Launch the first side hustle or freelance service you start

- Optimize tax withholdings to reduce refund (redirect to the monthly payments you make)

- Explore monetizing hobbies or skills you have

- Create systems for tracking the extra income you earn

Weeks 9-12: Build Momentum and Track Progress

- Make the first extra payment using the found money you discover

- Establish a visual progress tracking system that you use

- Join the accountability community you find

- Plan how to handle the upcoming windfall (tax refund, bonus) you expect

Bottom Line

Paying off $30,000 in student loans isn't just about math—it's about transforming your relationship with money and reclaiming control over your financial future. The strategies in this guide have helped thousands of borrowers accelerate their timelines and save thousands in interest they would have paid.

Choose one action from this guide and implement it today. Whether you set up automatic payments, start a side hustle or simply create your loan inventory, momentum begins with that first step you take.

FAQs

Generally you should pay off your private loans first since they have higher interest rates and fewer borrower protections. But compare your actual interest rates to make the best decision for you.

The SAVE plan is facing legal challenges so if you’re enrolled you’ll remain in forbearance. As of August 2025 interest started accruing on your SAVE loans. Many people are switching to Income-Based Repayment (IBR) for stability. Stay updated on policy changes at StudentAid.gov.

Yes! Through December 31, 2025 your employer can provide up to $5,250 annually in tax-free student loan assistance. This benefit may extend beyond 2025 so check with your HR department about available programs.

Paying off your loans faster will generally improve your credit score by reducing your debt-to-income ratio. But paying off all your loans may cause a small temporary dip as you lose that account’s payment history contribution.

If your loan interest rates are 6-7% or higher you should pay off the loans. If they’re 4% or lower consider investing your extra money instead. Between 4-6% it’s a personal choice based on your risk tolerance and financial goals.

Contact your loan servicer immediately. Federal loans have income-driven repayment plans, deferment and forbearance options you can explore. Private lenders may offer you temporary payment reductions. Never ignore the problem – it only gets worse over time.

Sources:

Education Data Initiative - Student Loan Debt Statistics: https://educationdata.org/student-loan-debt-statistics

Federal Student Aid - Federal Student Loan Portfolio by Age https://studentaid.gov/data-center/student/portfolio

The Education Trust - How Student Debt Harms Black Borrowers' Mental Health https://edtrust.org/rti/how-student-debt-harms-black-borrowers-mental-health/

U.S. Department of Education - Interest Rates and Fees for Federal Student Loans https://studentaid.gov/understand-aid/types/loans/interest-rates

Bankrate - What Is Employer Student Loan Repayment? https://www.bankrate.com/loans/student-loans/employer-student-loan-repayment/

Internal Revenue Service - Educational Assistance Programs https://www.irs.gov/newsroom/irs-reminder-employer-educational-assistance-programs-can-still-be-used-to-help-pay-off-workers-student-loans-through-dec-31-2025

Paycor - Employer Student Loan Repayment Program https://www.paycor.com/resource-center/articles/employer-student-loan-repayment-program-5-tips/

Internal Revenue Service - Student Loan Interest Deduction https://www.irs.gov/taxtopics/tc456

U.S. Department of Education - SAVE Plan Updates https://www.ed.gov/higher-education/manage-your-loans/save-plan

U.S. Department of Education - Federal Student Loan Collections https://www.ed.gov/about/news/press-release/us-department-of-education-continues-improve-federal-student-loan-repayment-options-addresses-illegal-biden-administration-actions

Federal Student Aid - Public Service Loan Forgiveness https://studentaid.gov/manage-loans/forgiveness-cancellation/public-service

University of Georgia - Student Loan Debt and Mental Health Study https://news.uga.edu/student-loan-debt-and-mental-health/

Scientific American - Student Loan Debt Mental Health Impact https://www.scientificamerican.com/article/student-loan-debt-takes-a-toll-on-a-vulnerable-populations-mental-health1/

Disclaimer:

The content provided is intended for informational purposes only. Calculations and estimates contained within may be based on current interest rates or third-party sources. The views expressed are those of the author and may not reflect the views of DebtConsolidationCare. We make no guarantees that the information will be accurate or applicable, and results may vary depending on individual situations. Student loan policies and rates change frequently. Contact a financial advisor and/or tax professional regarding your specific financial and student loan situation. Please verify current information with StudentAid.gov and your loan servicer.